For the second post-Brexit month in a row, consumers in the UK did not succumb to gloom and doom predictions. Retail sales did drop by 0.2% in August, but this was less than 0.4% expected. And, it came from higher ground. The number for July was revised up from 1.4% to 1.9%. Consumption in the immediate aftermath of the EU Referendum was thus even better.

Year over year, retail sales rose by 6.2%, also better than 5.4% expected. Excluding fuel, a drop of 0.3% was seen MoM (better than -0.6% projected) and also on top of an upwards revision. YoY, core sales are up 5.9% instead of only 5% estimated by economists.

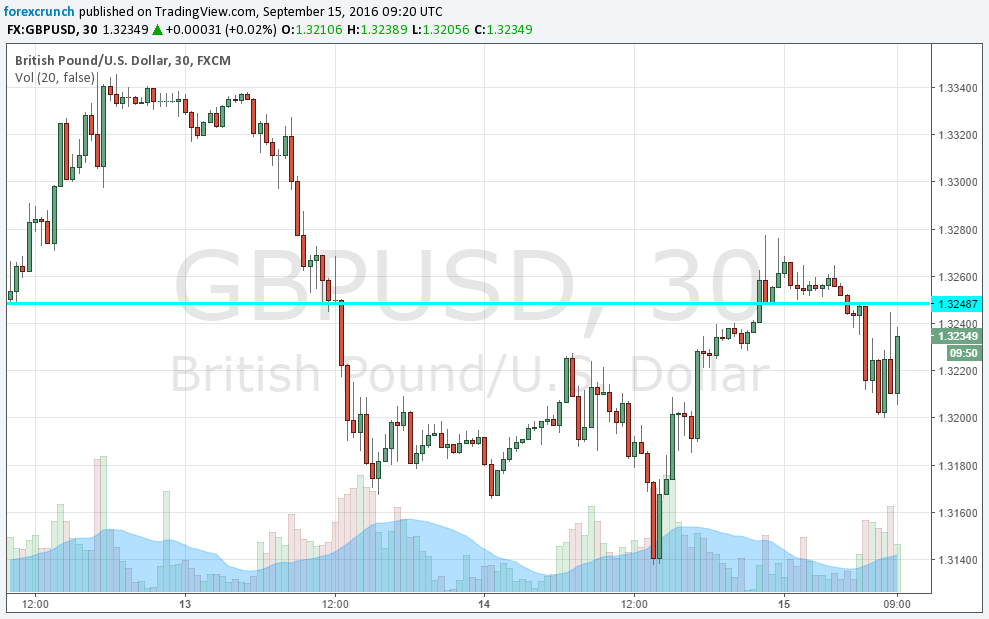

GBP/USD was expecting a worse outcome, sliding to the round 1.32 level just before the numbers came out. From there, cable bounced up to resistance at 1.3250 before settling.

Retail sales are important, but the bigger UK event of the day comes from the Bank of England. The “Old Lady” led by Governor Mark Carney, is set to leave policy unchanged for now, after announcing a blitz stimulus package in August. Carney was criticized by politicians for painting a dark picture for post-Brexit Britain, as well as acting too fast with the comprehensive package.

Carney defended the Bank’s actions, saying it was necessary and also tapping himself on the back for acting in due time to stabilize the economy. The meeting minutes that come with the retail sales report should shed some more light on the how the Bank views the current state of affairs. Another interest rate cut is due in November.

More: GBP To Gain Support In Q4; Go Long GBP/CHF – Nomura