Brexit? What Brexit? US consumer went on a shopping spree in July: retail sales are up 1.4%, far better than expected. Year over year, the figure is 5.4%. Excluding fuel, there is a rise of 1.5% and 5.9% y/y. All figures are beyond predictions. While this comes after a slide in June, the positive surprise is still significant especially given the political shock.

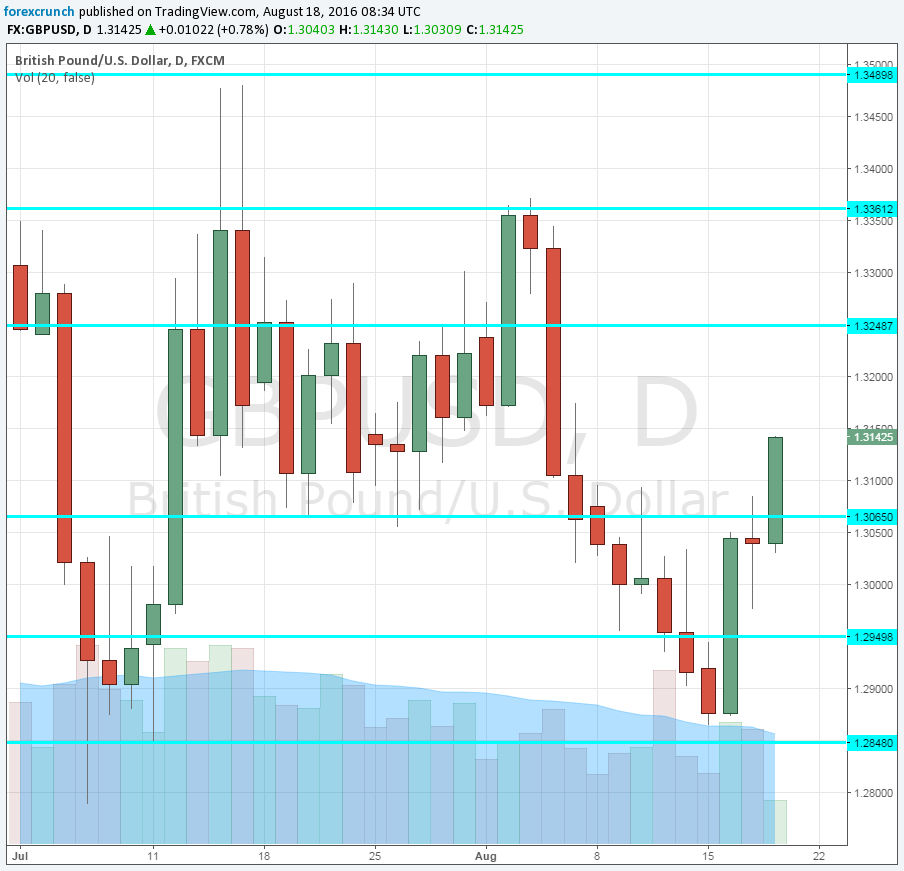

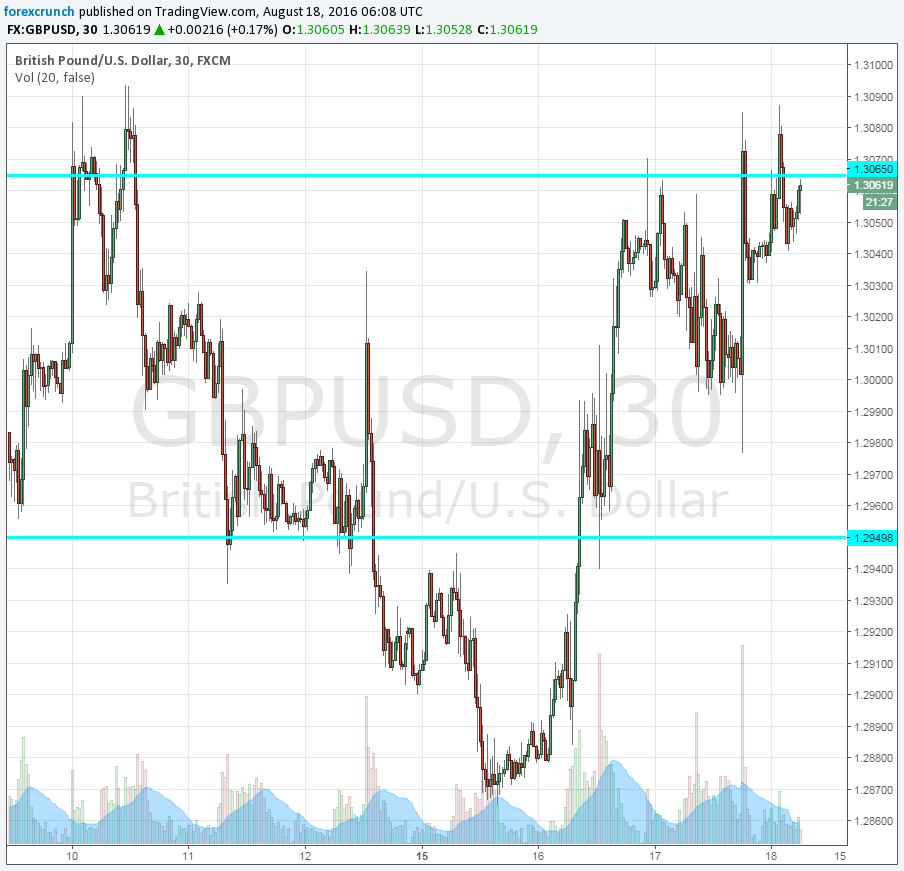

GBP/USD is storming higher, topping 1.31. The high so far is 1.3130. Update: the pair continues climbing with 1.3155 serving as the new high. This is the highest in two weeks. Hard data is more important than soft, survey data.

Apart from the slide in June, analysts note the contribution of clothing and BBQs to the mix – a seasonal impact rather than a genuine jump. Good weather in July in comparison to bad weather in June is cited as well. Yet again, the explanations do not stop the surge.

Here is the daily chart

The UK was expected to report a rise of 0.2% in retail sales in July, the first full month after the EU Referendum after a drop of 0.9% in June. Year over year, expectations stood on 3.9%. Excluding fuel, predictions stood on 0.4% m/m and 4.2% y/y.

GBP/USD traded around 1.3080

This is a key release as it shows what consumers actually did and not what they told surveyors – hard data and not soft data. Many wondered if the shock changed the behavior of consumers.

Earlier this week, we learned that jobless claims dropped in July while prices advanced more than expected. The positive data so far has strengthened the pound. This was compounded with weakness from the US dollar.