No big surprises in the UK retail sales report: the headline number is up 0.2% as expected, with a minor downwards revision for October. Year over year, the outcome is 5.9% as expected. Core sales beat expectations with +0.5% m/m and 6.6% y/y.

GBP/USD ticks up to 1.2530, a minor move, as the BOE looms.

The United Kingdom was expected to report a small gain of 0.2% in the volume of retail sales in November 2016, slower than 1.9% in October (before revisions). Year over year, a rise of 5.9% was projected. Core sales were forecast to edge up by 0.1% m/m and 6.1% y/y.

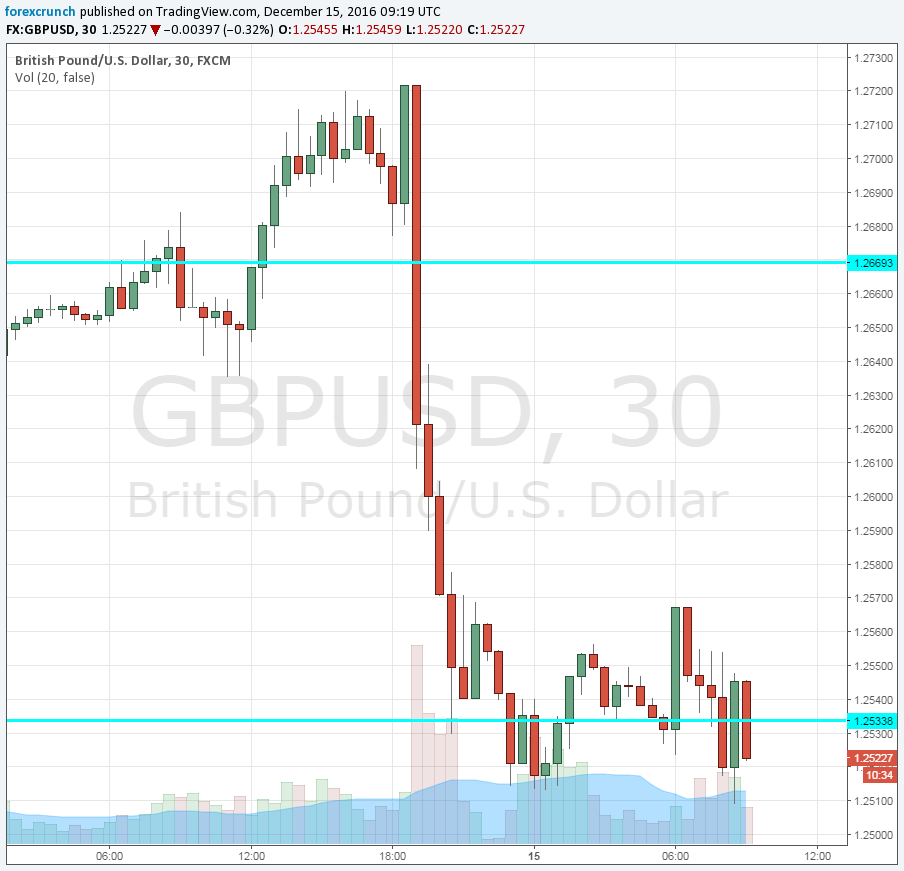

GBP/USD traded around 1.2525 ahead of the publication. Cable tumbled down on the hawkish hike from the Fed. Yellen and her colleagues not only raised rates but also lifted their forecast for 2017: three hikes are now on the cards.

So far, data has exceeded expectations in Britain: inflation and the jobs report both beat expectations. This all feeds into the UK’s rate decision later today. The Bank of England’s Monetary Policy Committee is likely to leave policy measures unchanged in its December meeting. Mark Carney and his peers had adopted a neutral stance in November when the “Old Lady” also published its Quarterly Inflation Report.

The next significant meeting awaits traders in February, with the next QIR. Uncertainty about what Brexit actually means makes decision making harder.

Here is the GBP/USD chart, showing the big Fed-fuelled fall: