UK retail sales advanced by 0.3%, but with a downwards revision for the previous month. Year over year, the rise is 1.3%, slightly below 1.4% expected. Excluding fuel, we also have better than expected numbers with downwards revisions: 0.5% m/m after 0.6% beforehand and 1.5% y/y after 2.8% in June.

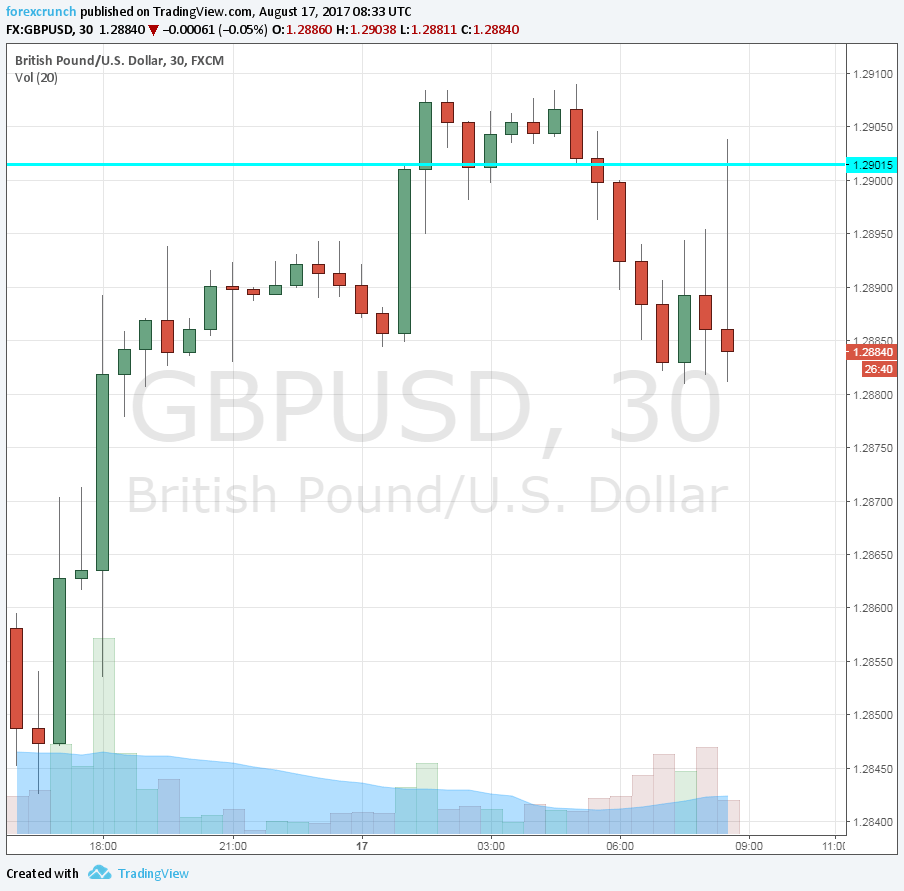

GBP/USD initially topped 1.29 but is now erasing its gains. This is a mixed report.

This concludes the trio of top-tier UK data for this week. GBP/USD is now at the mercy of the dollar, which has its own 3 troubles.

The UK was expected to report a small rise of 0.2% in the volume of retail sales in July, slower than 0.6% in June (before revisions). Year over year, a rate of 1.4% was expected. Excluding fuel, a rise of 0.2% m/m and 1.3% y/y were on the cards.

GBP/USD slipped ahead of the publication, trading at 1.2880.

Earlier in the week, inflation missed expectations while the jobs report was excellent.