All the figures beat on the UK jobs report: wages are up to 2.1% y/y in both headline salaries and wages excluding bonuses for June. The unemployment rate is down to 4.4%, also better than expected. The number of jobless claims for July dropped by 4.2K, better than a rise in the number of the jobless that was expected.

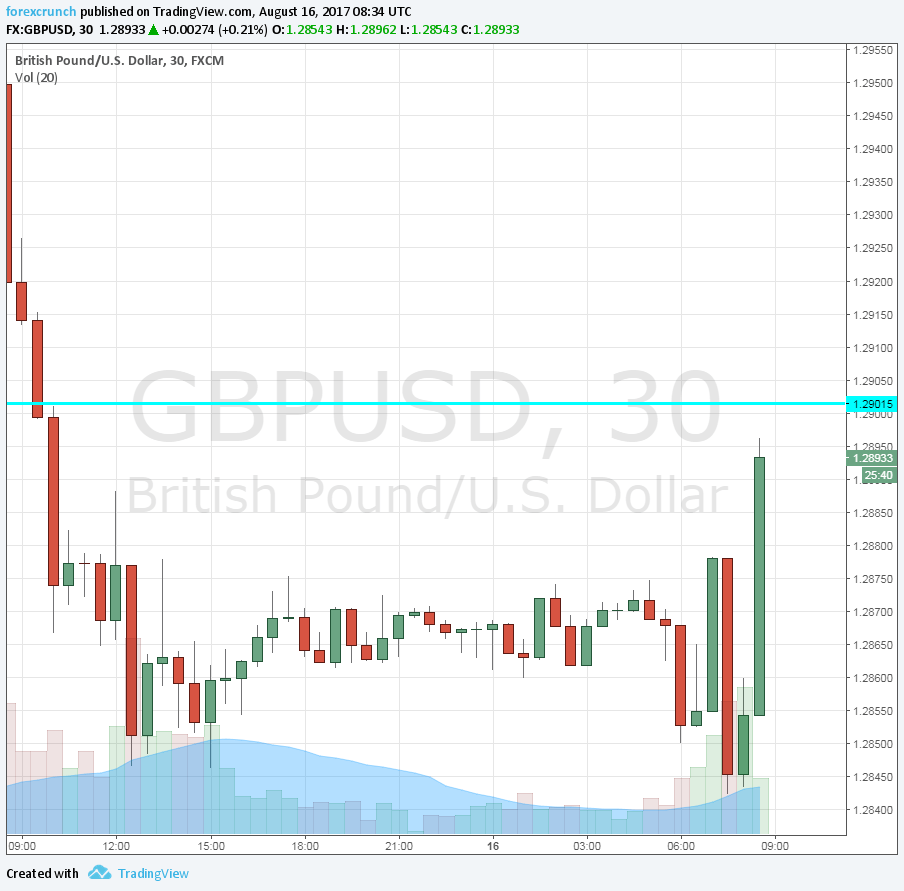

GBP/USD is up, challenging 1.29, which is a level of resistance. Further resistance awaits at 1.2980. The high so far is 1.2896.

It is important to note that standards of living are still falling: inflation in June stood at 2.6% while wages lagged behind at 2.1%.

Here is the chart:

The UK was expected to report a small rise in the number of the jobless in July: 3.9K against 5.9K in June (before revisions). The unemployment rate carried expectations for staying at 4.5% in June. Wages were predicted to stand at 1.8% y/y and wages excluding bonuses were forecast to stand at 2% y/y once again.

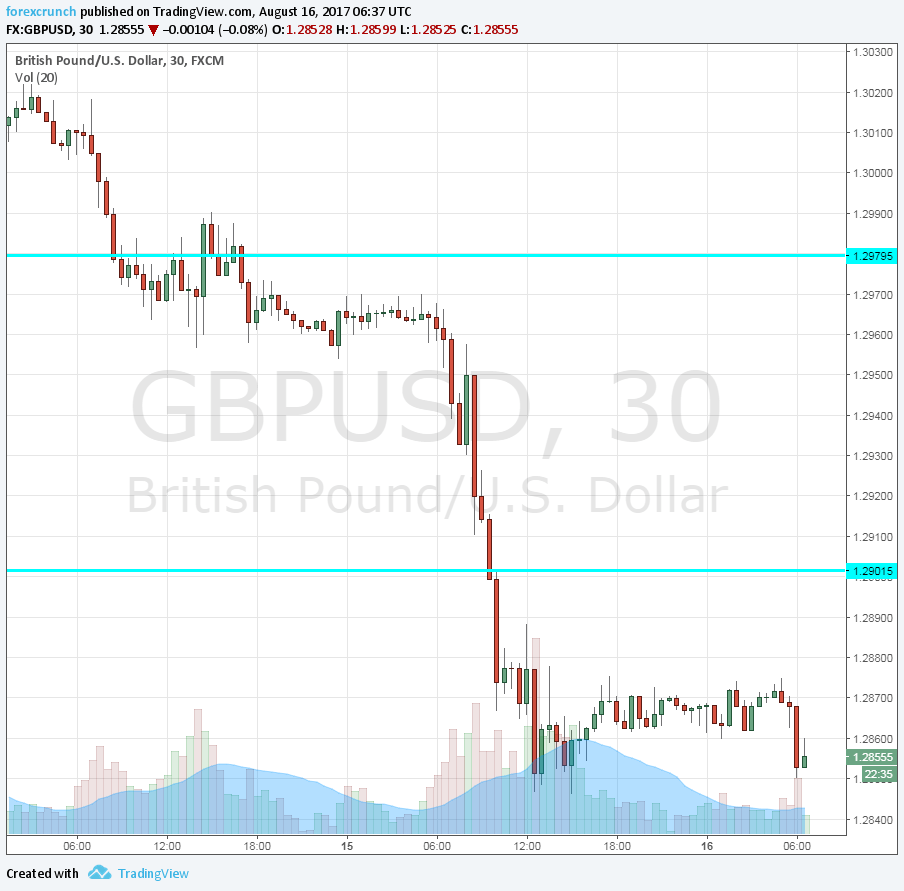

GBP/USD was on the back foot. The pound suffered a small miss on the inflation report yesterday. With no acceleration in prices, the BOE has no reason to raise rates. In the US, the upbeat retail sales numbers gave a boost to the greenback.

GBP/USD traded around 1.2850. Support awaits at 1.2820 and 1.2770. Resistance is at 1.29. The pound is also weaker against the yen and the euro.