Standards of living continue falling in the UK: wages are up only 2.1% in April, down from a downwards revised 2.3%. Excluding bonuses, wages are up only 1.7%, also below expectations. The unemployment rate us unchanged at 4.6%.

The number of unemployed is up 7.3K in May, slightly better than expected, but it is not a big surprise.

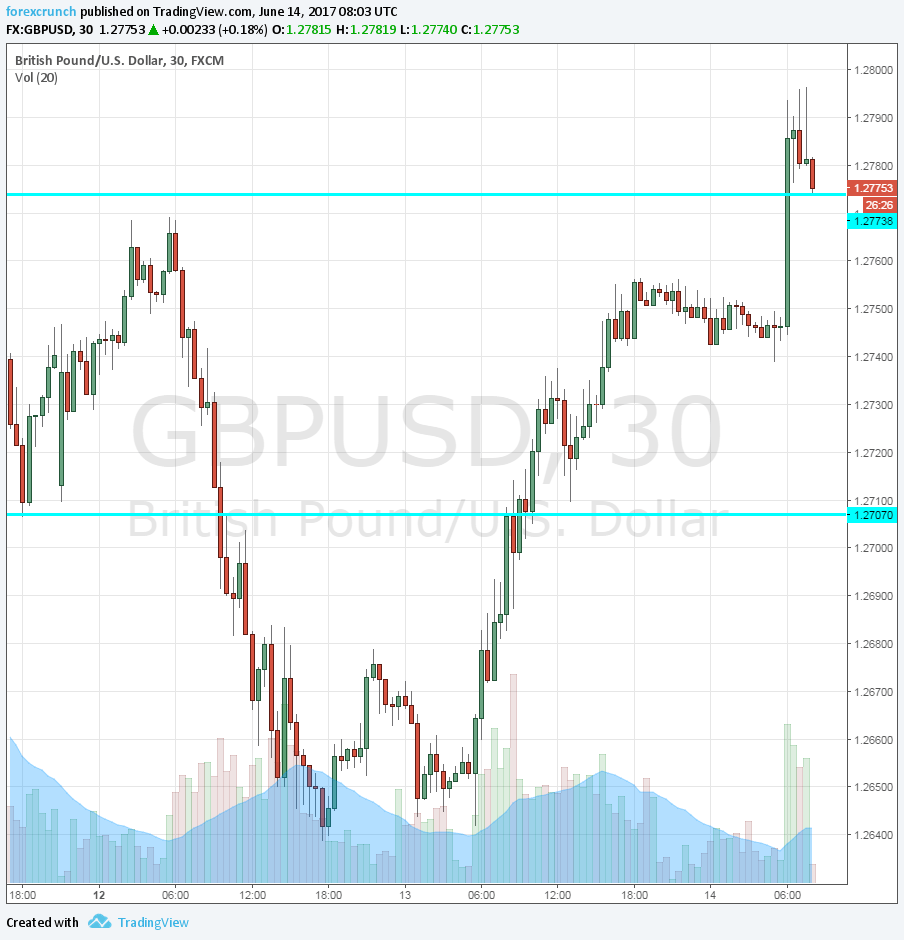

GBP/USD dropped below 1.2750 but bounced. Most of the fall happened before the publication.

The UK was expected to report a rise of 10K in jobless claims in May, after 19.4K in April (before revisions). The unemployment rate for April was predicted to remain unchanged at 4.6%. More importantly, wages were projected to rise by 2.4% y/y, the same as in March. Excluding bonuses, salary increases carried expectations for 2% after 2.1%.

Wage growth falls behind the rise in prices. We just learned that inflation hit 2.9% y/y in May. This means that real wages are falling and that standards of living are deteriorating.

GBP/USD was trading higher on hopes for a softer Brexit. The pair was around 1.2780 ahead of the publication. However, in the minutes before the release, the pair slipped under 1.2760. Once again, there may have been rumors that sent the pair lower.

The British pound was hit hard from the inconclusive UK elections. Cable dropped immediately from 1.2950 to 1.27 and bottomed out at 1.2640. However, as PM Theresa May clings on to power and hopes for a softer Brexit emerge, the pound is recovering.