Wages in the UK slowed down to an annual rise of 1.8%, significantly worse than expected. When excluding bonuses, the level remained unchanged at 2.2%, as expected. So are bonuses to blame? It doesn’t look good anyway, even if the unemployment rate remained at 5.1% in February. Moving to data from March, things are not too pretty for the future: the number of jobless claims rose by 6.7K, against a drop expected. In addition, February’s data was revised a slide of only 9.3K instead of -18K expected.

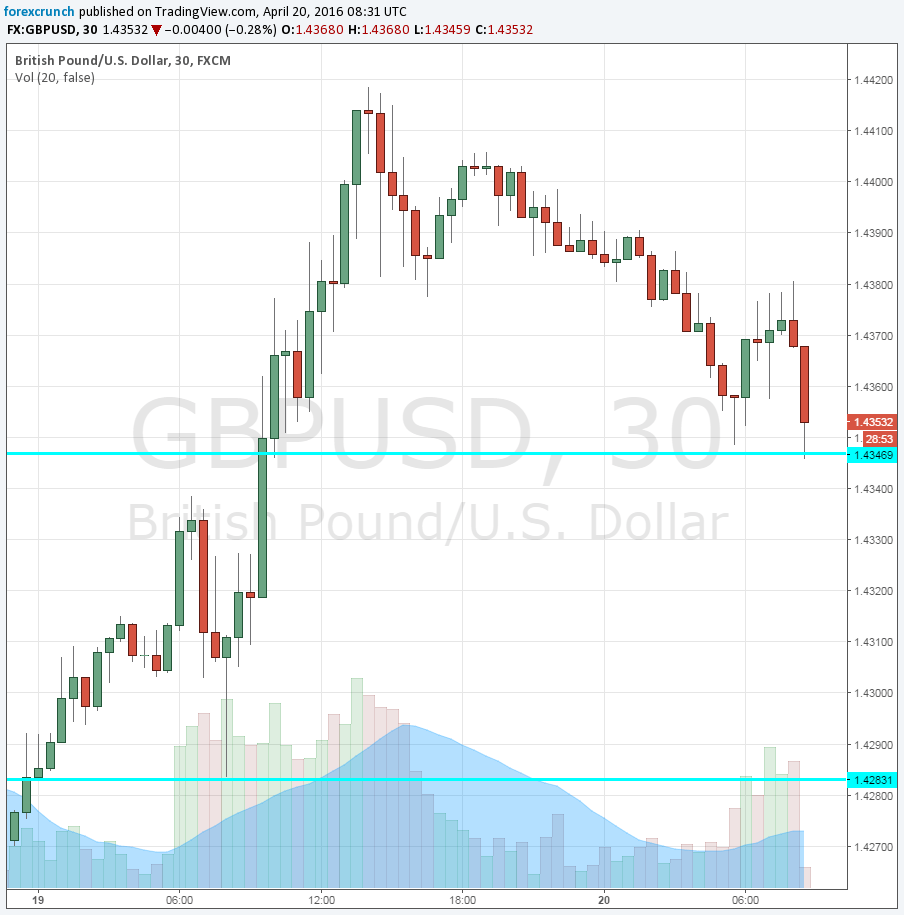

All in all, the data is worse than expected or meeting expectations at best – no silver lining. GBP/USD reverses its previous gains and slides.

The UK was expected to report a rise of 2.3% in average hourly earnings y/y including bonuses in February, up from 2.1% last time. Excluding bonuses, the same level of 2.2% was expected. The unemployment rate was expected to stay at 5.1%. Jobless claims, known also as Claimant Count Change, carried expectations for a drop of 11.3K in March, less than the surprisingly positive -18K seen in February.

GBP/USD traded around 1.4380 towards the release, bouncing from the lows of 1.4350 it saw earlier. Were traders anticipating a good outcome?

Yesterday, cable enjoyed the sell-off of the US dollar and crossed the 1.44 at one point. BOE governor Mark Carney poured some cold water on the pair with his Brexit warnings. He talked about uncertainty, trouble funding the trade deficit and an option of cutting interest rates.

Tomorrow we also get an important UK publication: retail sales. See how to trade the UK retail sales with GBP/USD.