No surprises in the US inflation report: prices are up 0.3% m/m and 2.1% y/y. Core inflation, which is watched by the FED, is up 0.2% m/m and 2.2% y/y.

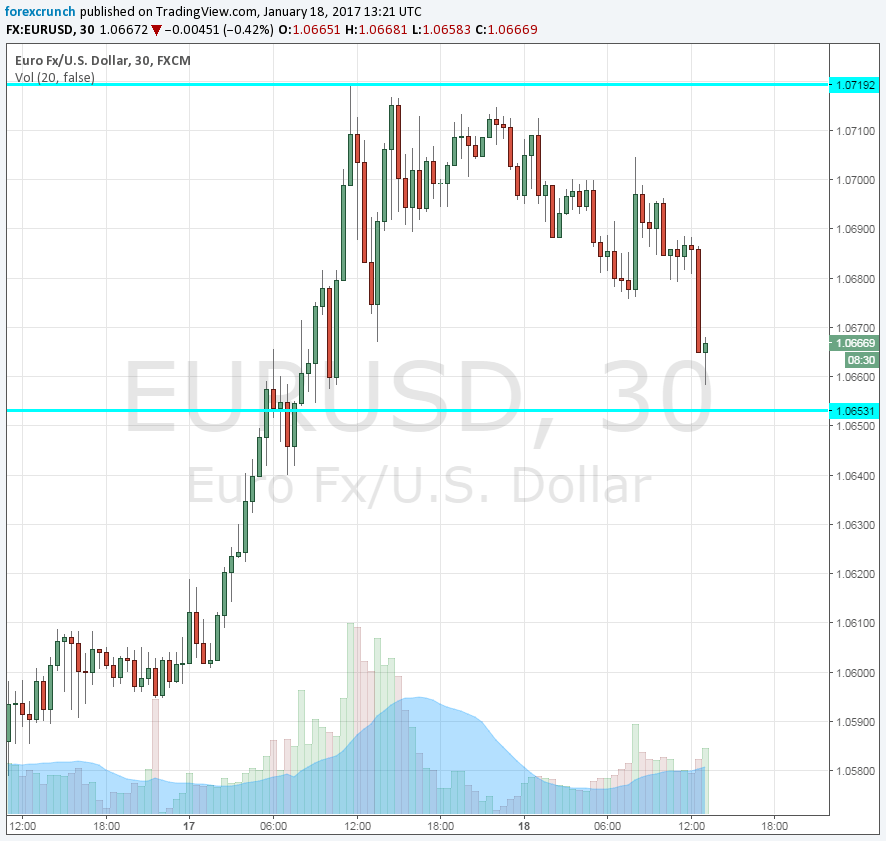

Nevertheless, the higher prices come on the background of a strengthening US dollar and enhance this move. The greenback edges up against the euro with EUR/USD slipping to 1,0660. GBP/USD is capped under 1.23, USD/JPY is above 113.50, USD/CAD tops 1.31, AUD/USD is at 0.7550 and NZD/USD is trading under 0.72. Update: the moves are quite shallow.

The United States was expected to report a rise of 0.3% in prices in the month of December, an accelerated pace in comparison to 0.2% in November. Core CPI carried expectations for 0.2%, a repeat of the previous month. Year over year, headline CPI was predicted to rise from 1.7% to 2.1%. Core CPI was projected to edge up to 2.2% from 2.1%.

The US dollar was on a recovery path after suffering a significant sell-off. Worries about Trump’s policies hit the rally.

Later today we will hear from Fed Chair Janet Yellen, in her second public appearance this week. Beforehand, we will get the updated industrial output data.

Here is how the EUR/USD chart looks. The pair dropped from the highs of 1.0720 but maintains a safe distance from the 1.0650 support level.

More: Dollar down on Donald Disappointment; pound does not mind the gap [Video]