Idea of the Day

It felt like we were heading towards an agreement in the US last week, only for it to fall apart over the weekend. In theory, the US debt ceiling will be hit later in the week, meaning the prospect of a US default remains a real and present danger. More negotiations are set to take place today, with Democrat leaders in the senate confident that a deal will be reached. The FX reaction remains relatively muted. The yen is still the most sensitive currency to the developments in the US, having moved towards the 98.00 level in early Asia trade, with the dollar only modestly softer vs. other currencies. If leaders continue to talk, then further dollar weakness is likely as the week goes on.

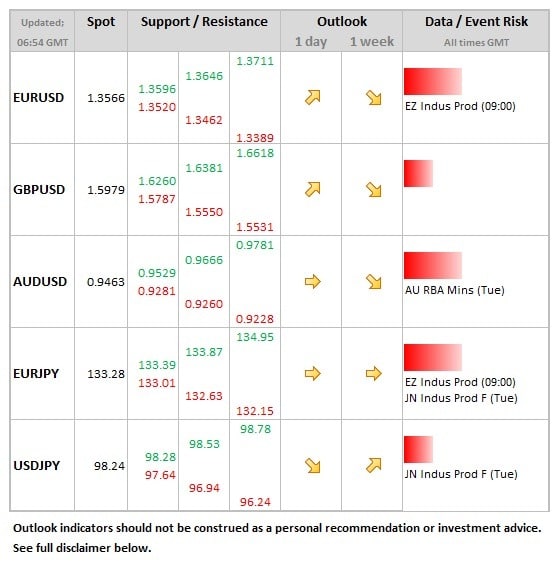

Data/Event Risks

USD: More talks are scheduled for today between house leaders, but being scheduled later in the US day, no progress is likely to be seen during European hours.

AUD: The minutes to the last policy meeting are released overnight. The RBA is now seen on hold, so impact on the Aussie should be limited.

Latest FX News

CNY: Inflation pushing ahead to 3.1% in September, from 2.6% in August. Food prices were the main factor pushing the headline rate higher. Trade data over the weekend showed a sharp drop in exports, falling 0.3% in YoY terms.

JPY: The yen outperforming overnight as the US situation moves away from resolution. USDJPY gapped lower towards the 98.00 level, but trading steady in the 98.25-35 area thereafter.

AUD: Data on home loans for August showing greater than expected fall, down 3.9%, after 2.1% rise in the previous month. Partly as a result of this, the Aussie has been one of the weaker performers at the start of the week.

Further reading:

Gold Extends Decline to Three-Month Low

Canadian unemployment rate drops to 6.9% – USD/CAD falls