One of the reasons that EUR/USD is trending higher stems from the divergence in growth. The euro-zone economy has grown at an annualized pace of 2% in Q1 2017 (0.5% q/q) while the US lagged behind with only 0.7% annualized according to the first release.

The second release of US GDP is expected to show stronger growth of 0.9% annualized. Even if the actual outcome meets expectations, it still shows the gap between both sides of the Atlantic. And this, in turn, may provide an opportunity to see EUR/USD extend the trend.

Recent economic data has disappointed

The first estimate of growth was not the sole disappointment. On the inflation front, both Core CPI and the Fed favorite Core PCE Price Index fell short of expectations.

Also, the price of labor is not going anywhere fast. While the US economy is gaining more jobs, full employment seems to be elusive. Not only is the pace of job gains still high, wages are still stuck at 2.5%. Other top-tier figures such as retail sales and durable goods orders were quite mediocre.

Other top-tier figures such as retail sales and durable goods orders were quite mediocre. On this background, it is hard to argue for strong Q1 growth. The components of this growth are just not there.

What about the seasonal effect? In some of the past years, but not in all of them, the first quarter saw a poor growth rate but this was followed by a big rebound. Well, 2016 saw only 1.6% growth in total and not all the first quarters were weak. In addition, there were substantial storms to blame the poor growth on.

All in all, it is hard to see a significant revision.

And as aforementioned, even a growth rate of 1% annualized is still half of that in the euro-zone.

5 Scenarios

- As expected: A growth rate of 0.8% to 1.2% would fall within expectations but the dollar could fall.

- Above expectations: A significant upwards revision to 1.3% or above could already raise the stakes for a rate hike in June and the dollar could rise.

- Significantly above expectations: Matching the eurozone’s 2% or above would set a dollar rally, but is highly unlikely.

- Below expectations: An “unchanged” outcome at 0.7% or below would be disappointing and could see the dollar quickly drop.

- Well below expectations: The worst case scenario would be outright contraction: a negative growth rate. The greenback could plunge, but this is highly unlikely.

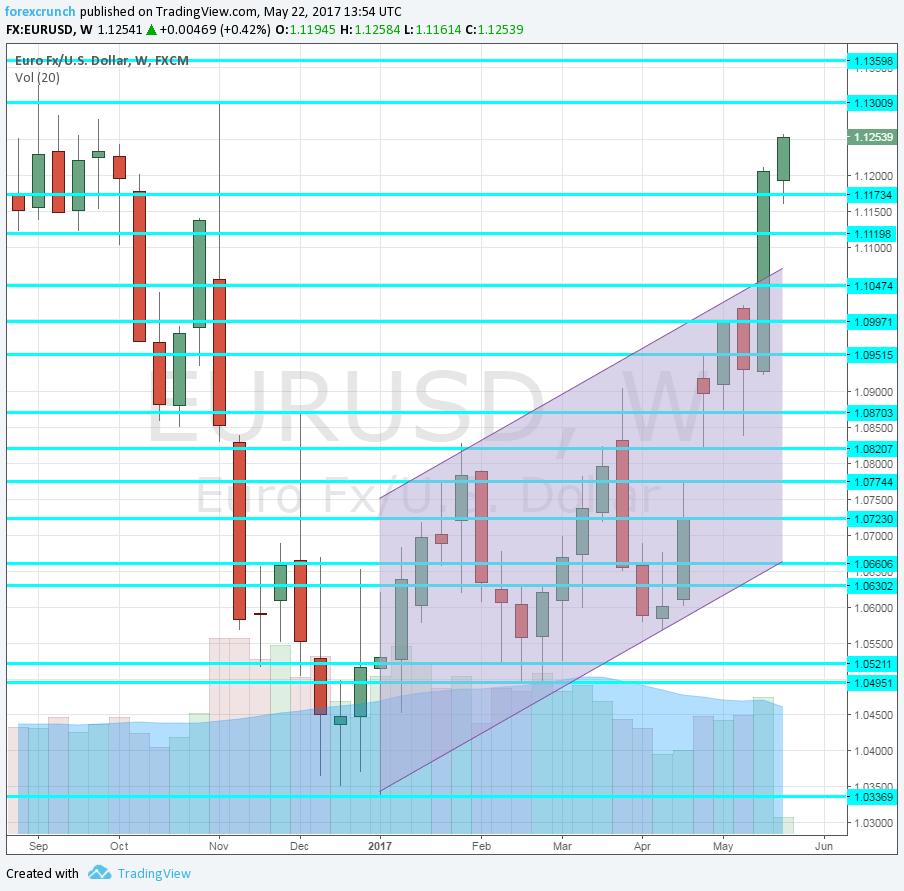

EUR/USD levels to watch

The cycle high for the pair has been 1.1266. The next line is 1.13 which was the swing high seen on election night in the US. Further levels of resistance await at 1.1360 and 1.1420.

Support is at 1.1170, that capped the pair after the recent rise. The next level is the veteran cushion of 1.1120. It is followed by 1.1050 and 1.0950, all were stepping stones on the way up.

The US releases its second estimate of GDP on Friday, May 26th, at 12:30 GMT.

More:

- EUR/USD: Roadblocks For A Continued Surge; What’s The Trade? – Danske

- EUR: Specs Started Buying Into Stronger EUR Outlook; What’s Next? – BTMU

And here is the daily chart, showing the recent trend: