The market was in a “sell the USD now, ask questions later” mode, and now it got some reasons to sell the greenback. The greenback extends its slide across the board, with commodity currencies still in the lead, followed by the Brexit-brave pound.

Building permits fell from 1.18 to 1.09 million (annualized) against 1.2 million expected. Housing starts dropped from higher ground: from 1.19 million to 1.09 million, also against expectations for a better outcome of 1.17 million annualized.

In many cases, one of these figures took a positive direction and the other a negative one, offsetting each other and turning this double-feature release into a non-event.

Not this time.

Both were negative and marked a fall for the greenback. Only the Japanese yen was sliding against the greenback, but as a reaction to the latest news, also the ultimate safe haven currency is taking advantage and rising to higher ground, with USD/JPY moving again towards 109.20.

GBP/USD has also made a nice move above resistance at 1.4365. BOE Governor Mark Carney is set to take the stage later on and he may pour some cold water on sterling, especially as he will be grilled on the Brexit debate.

USD/CAD is moving down to the round level of 1.27, AUD/USD is settling above 0.78 and NZD/USD has left 0.70 in the rear view mirror.

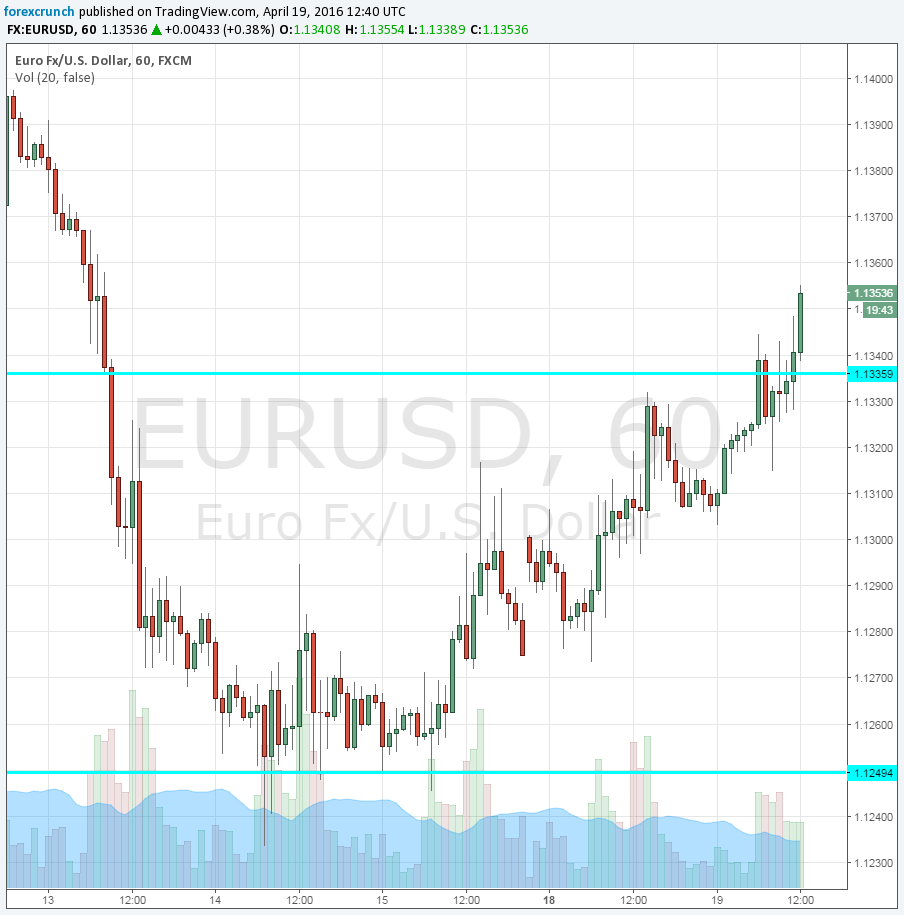

For EUR/USD, it serves as a confirmation of the break above 1.1335, after an initial failure beforehand.The pair now trades at 1.1357, already well within the previous 1.1335 to 1.1410 range.