The services sector is still growing quite nicely, but a bit under expectations. The ISM Non-Manufacturing PMI scored 56.5 points, 0.1 below 56.6 seen in December and under 57 expected. New orders are down to 58.6 points and employment is up from 52.7 to 54.7 points. Prices are at 59.9, up from last time.

Factory orders rose by 1.3%, better than 1% expected, but the ISM number is more important. Earlier, Markit’s services PMI was 55.6 against 55.1 originally reported.

The US dollar remains on the back foot.

The services sector report was supposed to show ongoing robust growth with a score of 57 points on the ISM Non-Manufacturing PMI. The survey showed 56.6 points in December 2016.

The US dollar was on the back foot following the mixed Non-Farm Payrolls report. The US economy gained more jobs than expected with 227K, but it came on top of downwards revisions. More importantly, wages badly disappointed with 0.1% m/m and 2.5% y/y.

The ISM number usually serves as a hint for the Non-Farm Payrolls, but the early publication, on the third day of the month, resulted in a later release. The services sector, which is the largest in the US, can shine on its own.

The greenback has also been hurt by an ongoing disillusionment from the new President. Donald Trump not only failed to provide fiscal stimulus but also caused friction in international relations. To add insult to injury, the Donald also talked down the dollar.

Here are three reasons to sell the dollar.

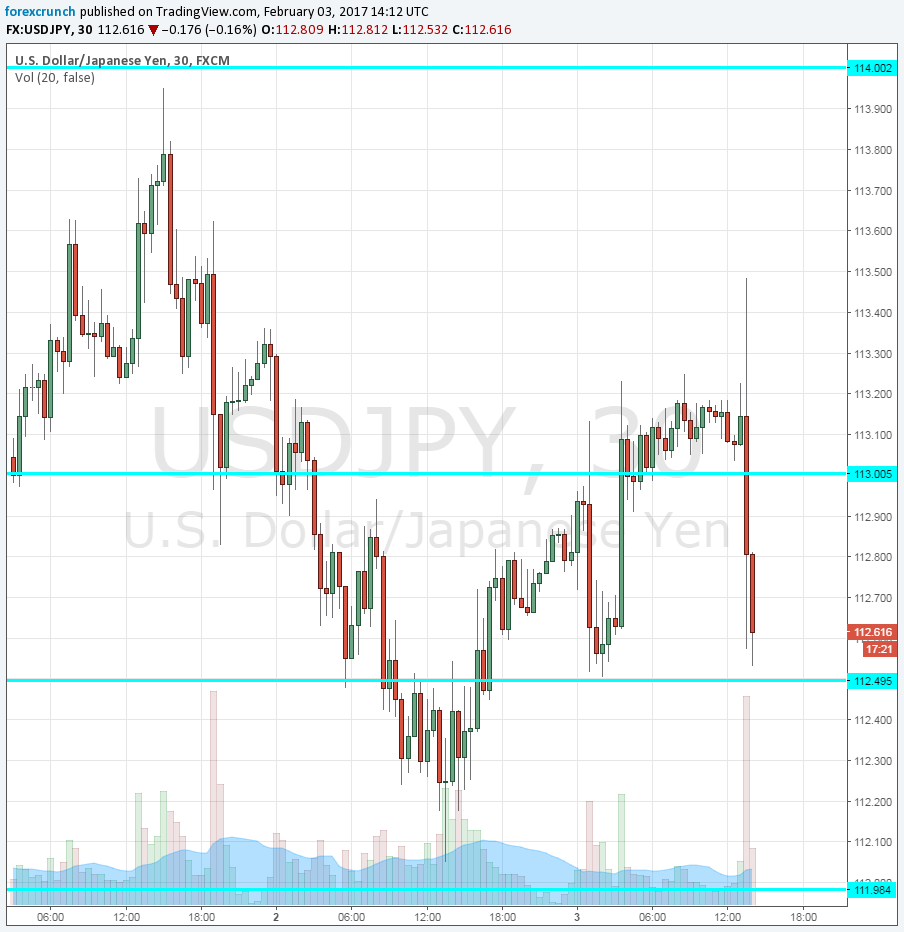

The Dollar/yen chart: