A small miss on US jobless claims: 285K, worse than 280K expected. This is not a big miss but enough to keep the pressure on the greenback.

The US dollar sell off continues, with hope for dollar bulls maybe coming from tomorrow’s Non-Farm Payrolls.

Unit labor costs are up 4.5%, which is actually better than expected. However, productivity (non-farm) came out at -3%, worse than expected. Continued claims stand at 2.225 million.

US jobless claims were expected stand at 280K after 278K last week. At the same time, the US also released unit labor costs, which were predicted to rise by 3.9% and non-farm productivity, which carried expectations for a drop of 1.5%. Both figures are preliminary for Q4.

The US dollar continued its free-fall before the publication, extending the losses that were triggered by the terrible services sector report. Bond markets do not price in any hikes for 2016.

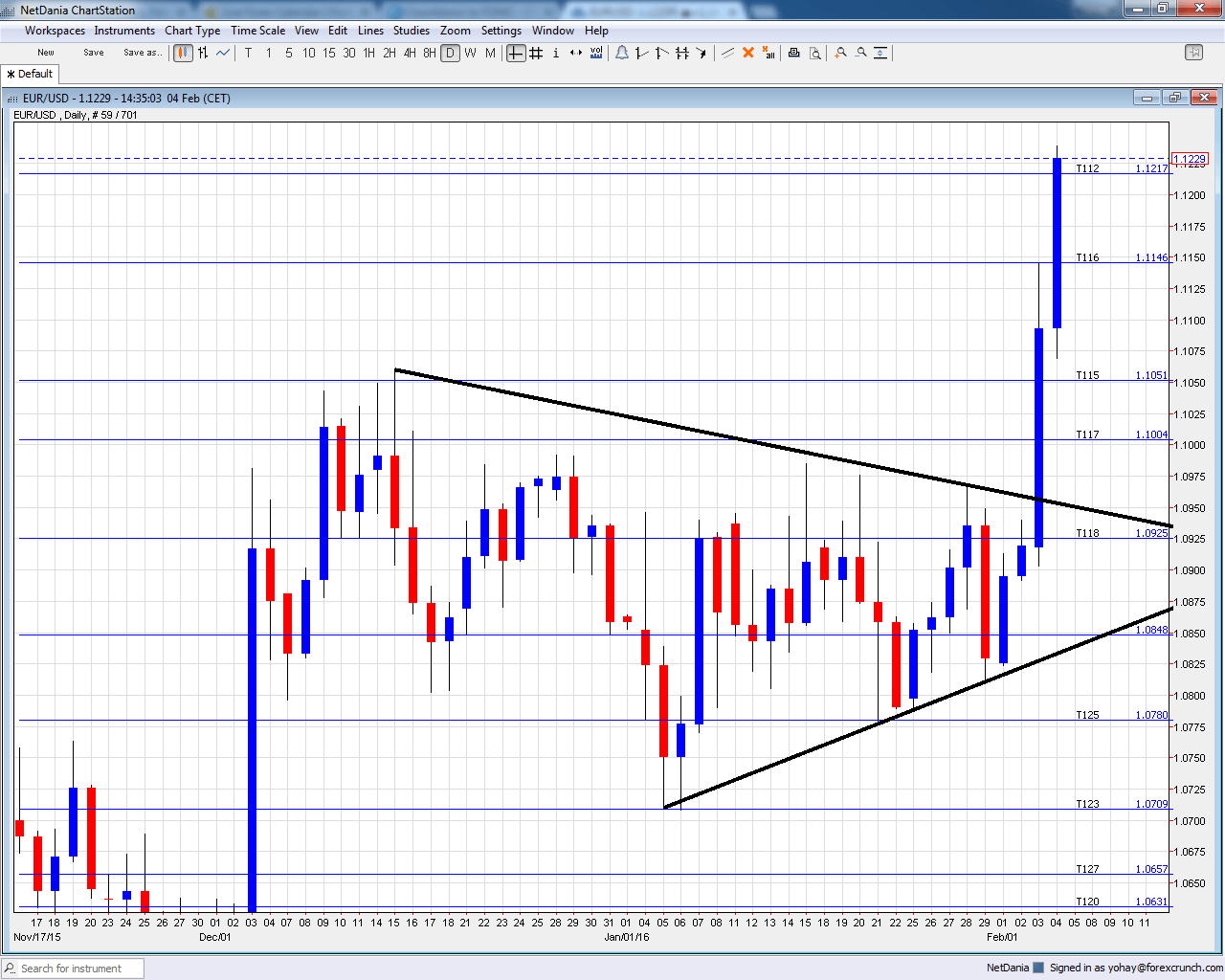

- EUR/USD traded at resistance at 1.125 after passing three hurdles.

- GBP/USD saw the BOE go dovish, took a dip, but continued higher back above 1.46.

- USD/JPY fell back to the lows around 117.25. The BOJ move is basically gone.

- USD/CAD is already 1000 off the highs of mid January, and is slightly impeded by oil.

- AUD/USD continues advancing beyond resistance at 0.7220.

- NZD/USD is at 0.6730, having settled above resistance at 0.67.

Tomorrow we have the biggest event of all: Non-Farm Payrolls.

See how to trade the NFP with EUR/USD