The Canadian dollar continued rallying against the US dollar, owing the move mostly to the greenback: the disappointing report on the services sector in the US has pushed rate hike expectations to 2017 and the dollar’s fall goes on and on.

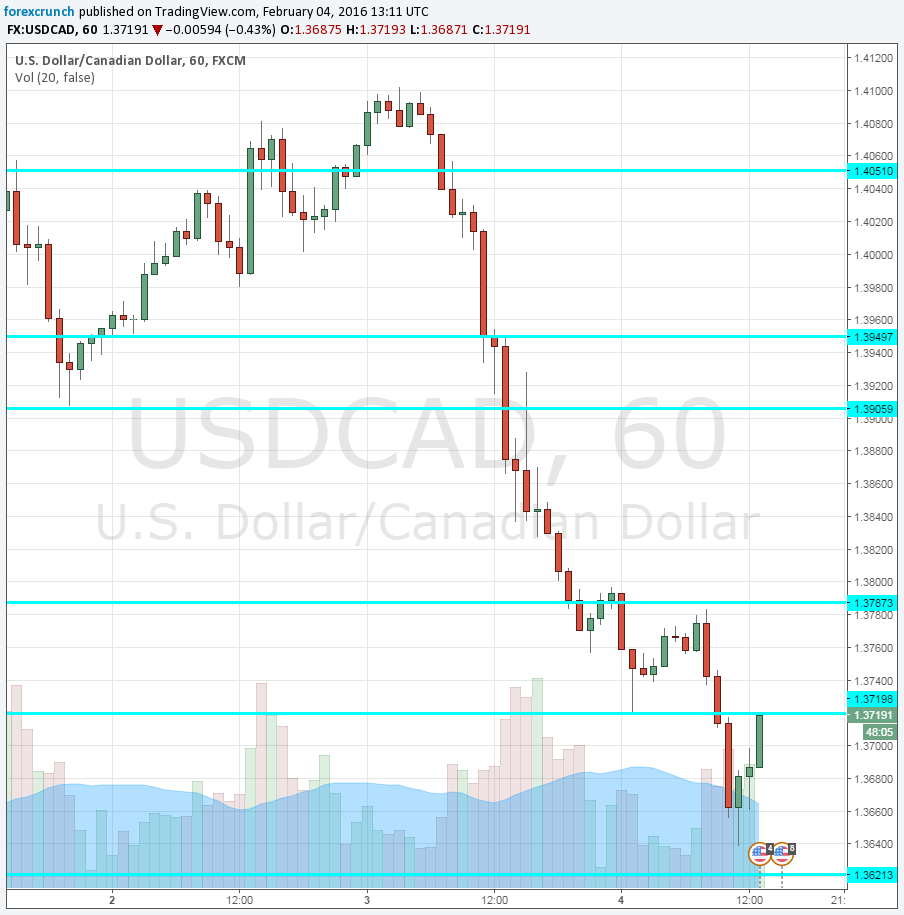

USD/CAD has already reached a low of 1.3640, more than a 1000 pips below the highs seen in mid-January, just before the BOC’s surprising “no cut”. However, a significant bounce worth around 100 pips has occurred as the Canadian dollar and oil face reality.

The price of black gold seems to remember that yesterday’s oil inventories data was terrible: a big jump in crude inventories and a smaller than expected slide in distillates: despite all the talk about OPEC collaborating with non-OPEC members to cut oil production, the current reality is that inventories keep on building: there is too much supply and not enough demand.

On this background, the pair resumes its falls to below $32 and USD/CAD trades above 1.37. Dollar/CAD continues its role as one of the most fascinating currency pairs out there: