US inflation is rising, at least at the producer level. PPI is up 0.4% m/m in both the headline and the core numbers. Year over year, PPI is up 2.8% and core PPI is up 2.4%. All the figures come up above expectations.

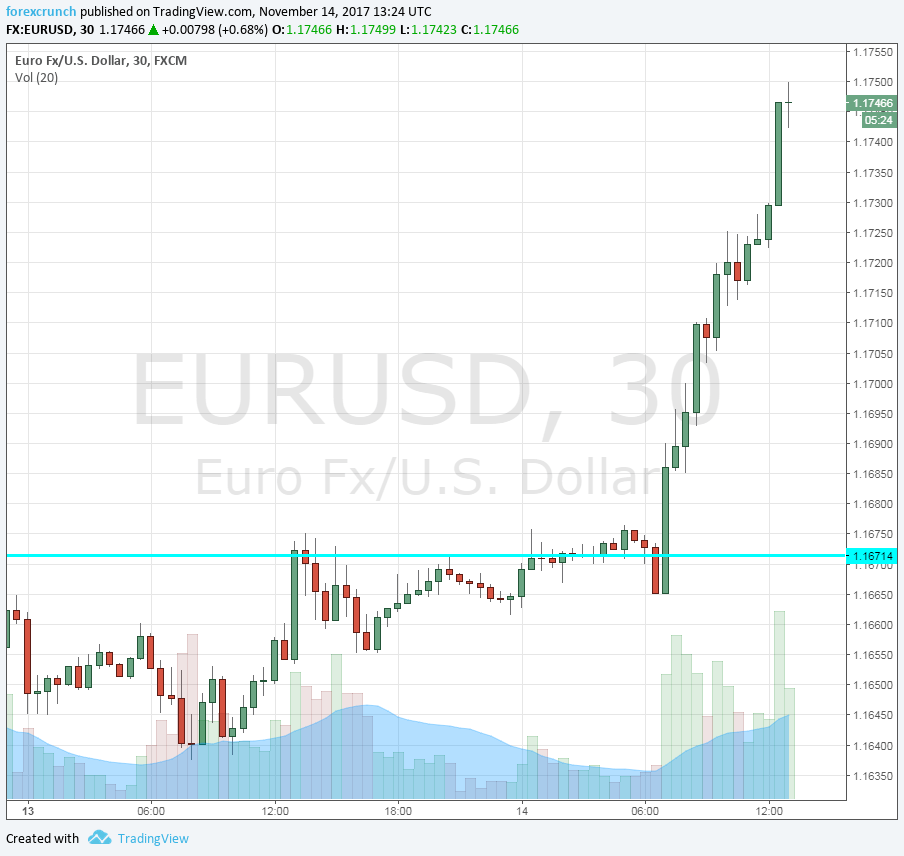

The US dollar is slightly stronger in the immediate aftermath. EUR/USD is slipping under 1.1740 after touching 1.1750 just before the publication.

PRoducer prices were expected to rise by 0.1% in October, slower than 0.4% in September (Before revisions). Year over year, a gain of 2.4% was expected after 2.6% beforehand.

Core PPI carried expectations of 0.2% m/m (0.4% in September) and 2.3% y/y, up from 2.2% in September. Producer prices feed into consumer prices. Despite relatively OK PPI numbers, consumer inflation has been soft, as the Fed recently described it.

Tomorrow we will get the CPI data alongside retail sales numbers.

Earlier in the day, Fed Chair Janet Yellen spoke alongside her peers from the ECB, BOE, and BOJ, but did not offer any earth-shattering news.

EUR/USD stood out with significant gains. The pair enjoyed rapid German growth reported early in the day. Other currencies were more mixed.