US retail sales finally shine: headline sales are up 0.6% in July, on top of a significant upwards revision for June: 0.3% against 0.2% originally reported. Core sales are up 0.5% against 0.3% and also on top of an upwards revision. The control group is up 0.6% instead of 0.4% and also here, it comes on top of 0.1% instead of 0.1%.

The US dollar is higher across the board on this much-needed positive surprise after a long list of disappointing data.

Here are the reactions:

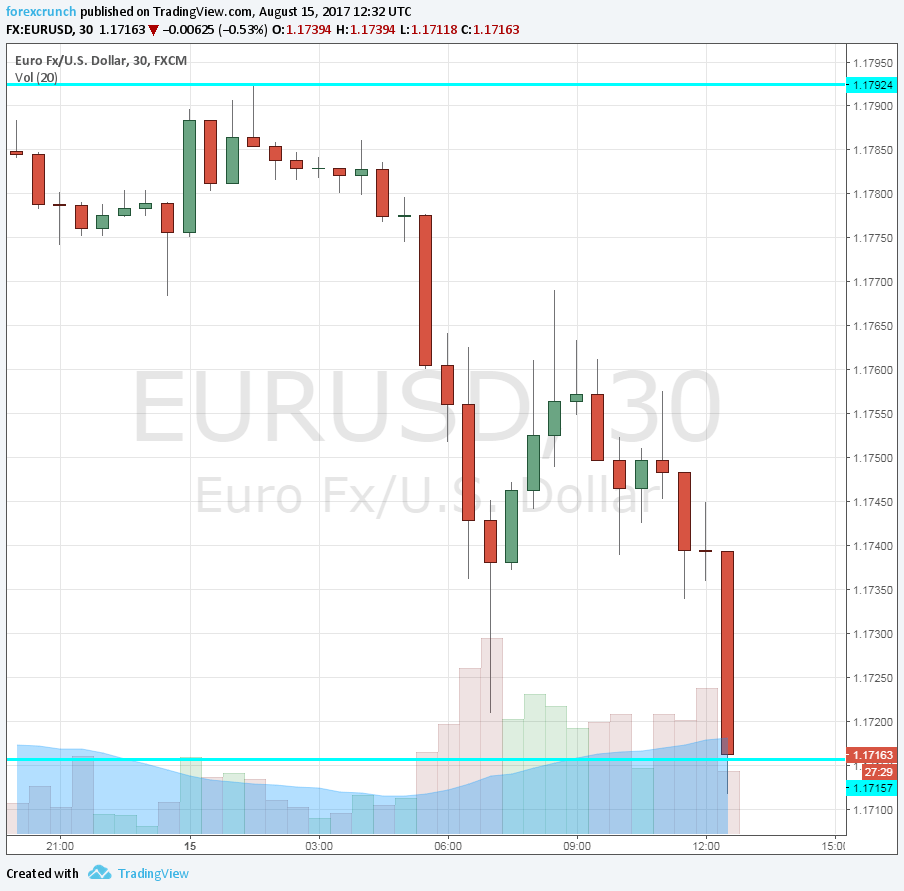

- EUR/USD was sliding from the highs, also due to a small miss on German GDP. The pair is now dipping its feet under the important support line of 1.1710.

- GBP/USD was hit by the recent Brexit negotiations and the miss on UK inflation. Cable extends its losses under 1.2860.

- USD/JPY surged as tensions with North Korea ease. We are now at resistance around 110.70.

- USD/CAD traded well above 1.27. The new level is 1.2770.

- AUD/USD was falling further away from 0.79. The pair falls below support of 0.7835 and reaches 0.7820.

In a separate report, the New York Fed Manufacturing Index jumped to 25.2 points. Import prices came out at 0.1%, as expected.

More: EUR/USD drops below 1.17 on the excellent data

Here is how it looks on the EUR/USD chart:

Retail sales in the US were expected to rise by 0.4% in July after falling 0.2% in June (before revisions). Core sales carried expectations for a rise of 0.3% after -0.2% and the control group was predicted to advance by 0.4% after a slide of 0.1% in the previous month.

In a separate report, the New York Fed Manufacturing Index was projected to tick up from 9.8 to 10 points.

The US economy is all about consumption. This time, the retail sales report is published on its own, without the distraction of the inflation figures.