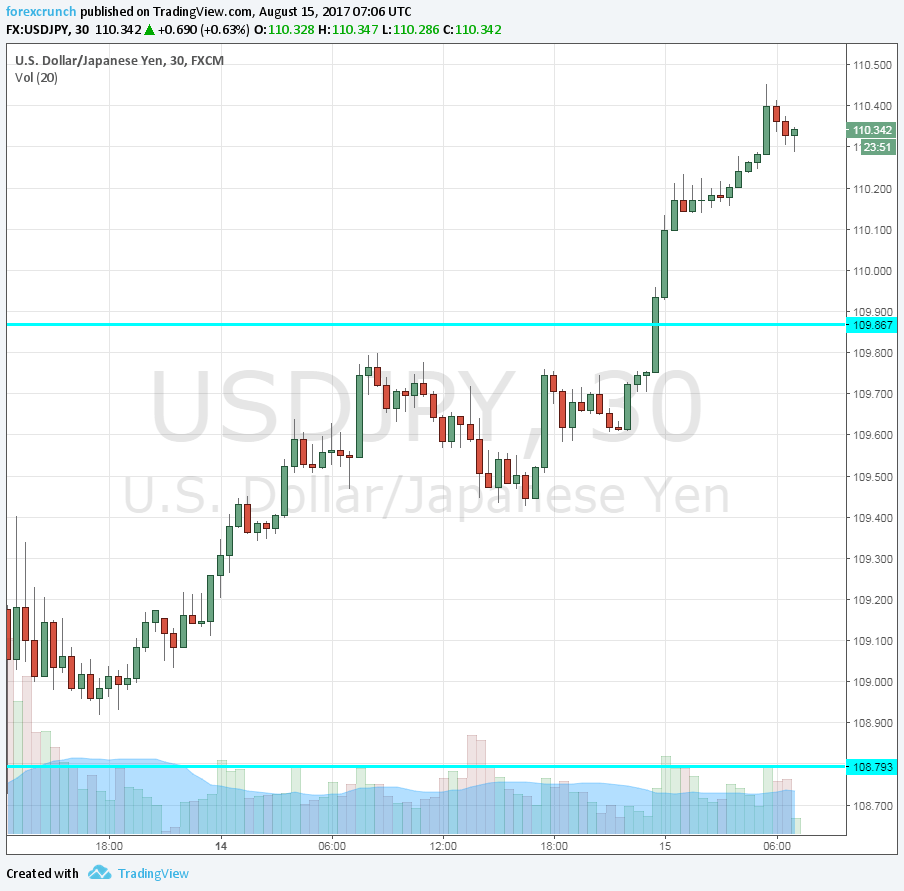

Dollar/yen is enjoying significant gains for the second day in a row. The summer lull must have skipped the pair, which already trades at 110.30, up some 70 pips on the day.

There are two reasons supporting the recent rise.

North Korea ease

Tensions between the US and North Korea have eased. The trend began over the weekend with some calming words from Trump’s more rational team members. In addition, the attention span just moved away to Charlottesville and away from Pyongyang.

The improvements continued as the Wall Street Journal reported that the rogue regime decided to abort plans regarding an attack on Guam. The threats were bombastic in the first place, but the reports about ditching them certainly help calm nerves all over the world.

The Japanese yen’s safe haven appeal is, therefore, less shiny, allowing a sell-off of the currency and USD/JPY to rise.

Finally infrastructure spending in the US?

The second development that we learned about concerns the US directly. One of the reasons for the dollar’s rise stemmed from Trump’s promises to fix America’s failing infrastructure. So far, the topic was pushed down the agenda as health care and tax reform grabbed the headlines.

But now, the President is set to sign an Executive Order that would open the door for some kind of investment. It may be potentially damaging to the environment: “establishing discipline and accountability in the environmental review and permitting process for infrastructure projects”

Will this turn into real projects? Not necessarily, but it is a move in the right direction for markets.

More: JPY: Why NK Risk-Driven Price-Action Is Different? Why 108s Key – BofAML

USD/JPY faces resistance at 110.70, followed by 111.70. Support is at 109.90 and 108.80.