US consumers went shopping in January: retail sales rose by 0.4% against 0.1% predicted. The figure for January was upgraded to 1%. Core sales have increased by 0.8 % instead of 0.4% with an upwards revision of 0.4%. The control group is up 0.4% instead of 0.3% predicted. The data excluding gas and autos is up 0.7% against 0% forecast. The various core numbers are all accompanied by upwards revisions.

Also, inflation is on the rise: prices increased by 0.6% m/m against 0.3% projected. Year over year, headline inflation is at 2.5%, a level that would cause worries in Germany. However, the Fed focuses on core prices. Core inflation is up by 0.3%, above 0.2% that was estimated. Year over year, core CPI is up from 2.2% to 2.3%, and above 2.1% expected.

The caveat is that real wages are down by 0.4% against 0% predicted. Year over year, wages are flat and did not advance by 0.8% predicted. While inflation is still tame, it is taking its toll on real salaries.

The Empire State Manufacturing Index jumped to 18.7 points, up from 6.5 and above 7.2 expected. It seems that America’s manufacturing sector is factoring in Trump’s factory promises.

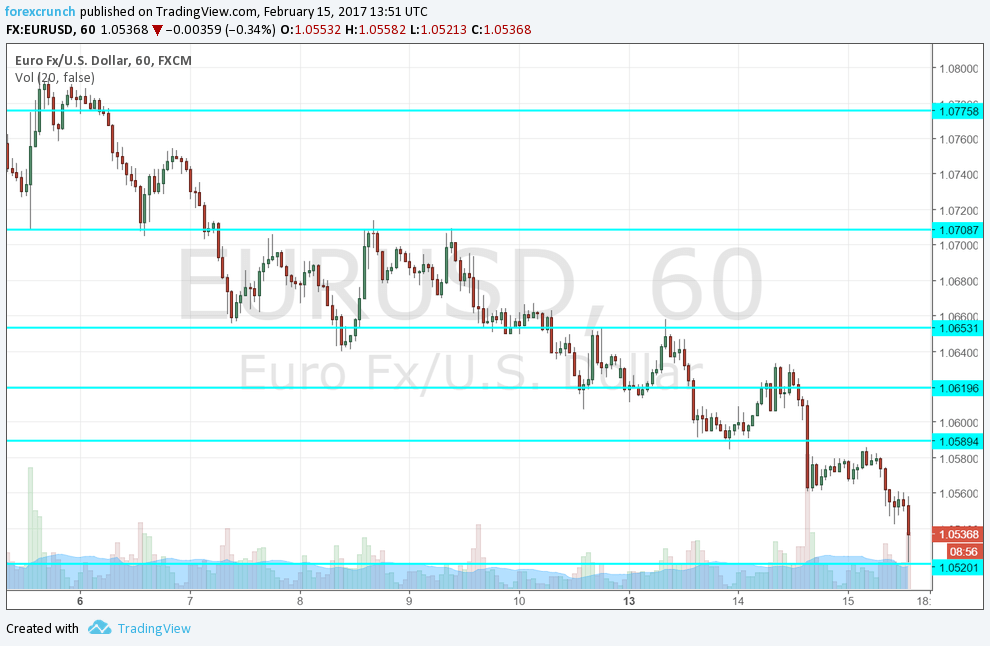

- The US dollar is higher across the board, with EUR/USD hitting support at 1.0520 – a strong support level that has not been broken yet.

- USD/JPY is getting closer to the 115 level. The pair jumped on Yellen’s testimony.

- GBP/USD drops below 1.24. It was hit earlier by slowing wage growth in the UK.

- USD/CAD is topping 1.31 Oil prices are not helping.

- AUD/USD is backing off from its attempt to break above 0.77.

- NZD/USD is around 0.7160.

More: Bullish on the US dollar – two opinions

more coming