- USD/CAD is facing downside pressure after upbeat Canadian jobs data.

- Better risk tone is further pressing down the pair.

- Bullish crude oil is keeping any upside in the USD/CAD limited

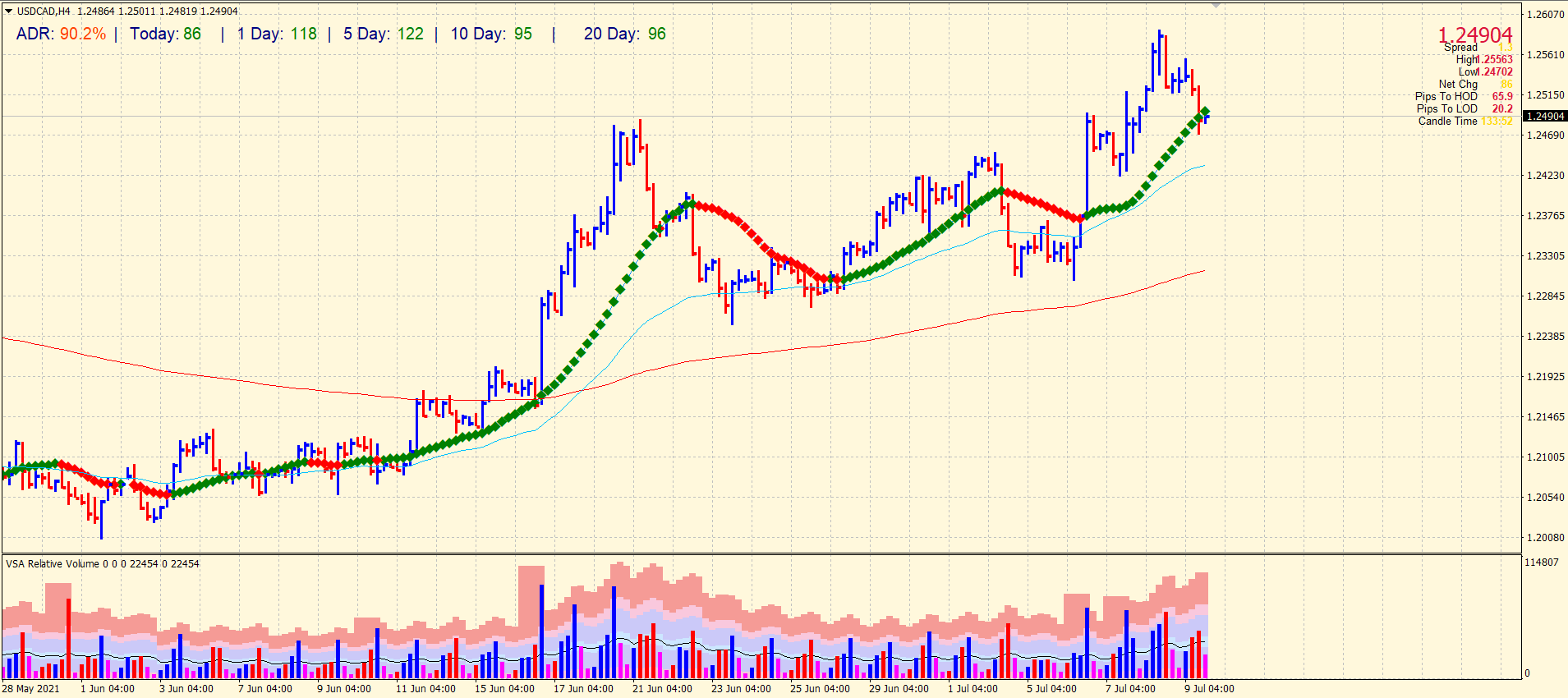

The bulls for the USD/CAD pair ran continuously for three consecutive days after posting two-week lows near the 1.2300 handle. After that, however, the upside could not sustain beyond 1.2589 and saw a sharp decline below the 1.2500 mark.

USD/CAD analysis after Canadian jobs data

The Canadian economy had reported the loss of 68k jobs in May. However, the economy added 230,700 jobs for June while the expected figure was 195,000. The jobs data was recently released by Statistics Canada.

On the other hand, the unemployment rate in Canada fell to 7.8% in June, which was 8.2% in May. However, the forecast was 7.7% which was slightly missed.

The USD/CAD analysis shows a bearish momentum, and the price dropped around 30 pips towards 1.2470 area when the jobs figures were published. Most forex signals have appeared with a selling bias.

However, the pair reversed its spike on jobs data. But the pair is still negative under 1.2500 with an intraday loss of -0.30%.

Risk sentiment weighing on the Dollar

The risk sentiment quite deteriorated till Thursday. Then, however, the day started with a better risk tone, and all the risk assets surged at the back of slightly increased risk appetite.

But this is not a long-lived trend in the risk as the Delta variant is spreading fast in the UK and Europe, and Asian countries. So, we can see a risk reversal sooner or later.

Crude oil prices

Crude oil prices picked up pace after finding a near-term bottom. The factor is also keeping the bulls for USD/CAD under pressure. Furthermore, the trend in oil prices is still very healthy.

USD/CAD technical analysis: Bears to get stronger

The USD/CAD pair fell below the 20-period SMA on the 4-hour chart. However, the fall is not much significant, and the price is still close to the 20-SMA. So far, the currency pair is done with 90% of the average daily range. It means that the pair is almost done for the day and may find a fresh trend direction after the weekend. The volume is supporting the downside as bearish volume is slowly rising as a result of automated trading. The immediate price background is also bearish with a price rejection (widespread down bar with ultra-high volume).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.