Dollar/CAD consolidated its previous gains US yields pushed the greenback higher. Will it continue further? GDP, and another appearance from Poloz stand out. Here are the highlights and an updated technical analysis for USD/CAD.

The Canadian dollar managed to weather the US Dollar storm relatively well. The greenback was on the move as 10-year Treasuries surpassed the 3% level for the first time since 2011. While bond yields retreated, the dollar remained strong. In Canada, Poloz and Wilkins repeated the same cautious lines about inflation and monetary policy. Oil prices stabilized and NAFTA talks saw progress, but without white smoke as of yet.

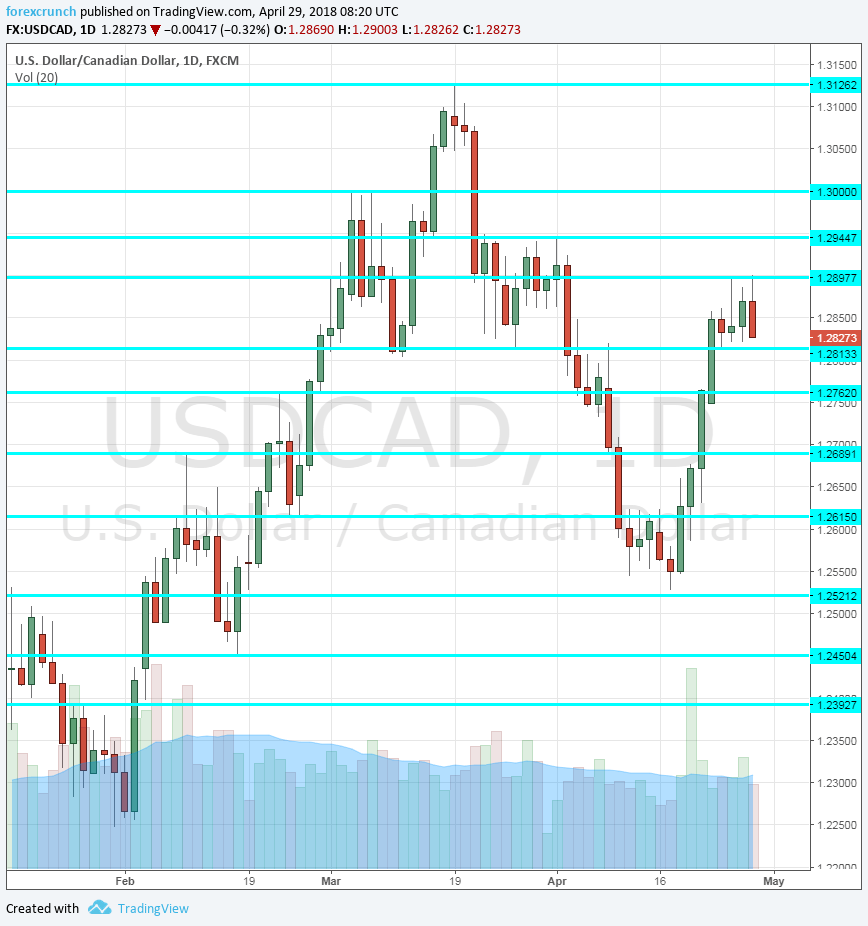

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- RMPI: Monday, 12:30. The Raw Materials Price Index dropped by 0.3% in February. The indicator implies future consumer inflation. The This time, a gain of 0.6% is on the cards. The accompanying Industrial Product Price Index (IPPI) is projected to advance by 0.2% after a modest rise of 0.1% last time.

- GDP: Tuesday, 12:30. Canada is unique in publishing monthly GDP reports. The economy surprisingly shrank in January by 0.1% and is now expected to rebound in February by 0.3%. The Bank of Canada expects slow growth in Q1: 1.3% annualized according to the latest forecasts.

- Manufacturing PMI: Tuesday, 13:30. Markit’s purchasing managers’ index showed OK growth in March: a score of 55.7 points, similar to the results in previous months. Any score above 50 represents expansion.

- Stephen Poloz talks: Tuesday, 18:30. The Governor of the Bank of Canada delivers a speech in Yellowknife and will also receive questions from the audience. He will have the opportunity to respond to the latest GDP figures and perhaps to trade negotiations. Regarding monetary policy, the recent appearances by Poloz have already supplied lots of inflation about the cautious, data-dependent approach and it is hard to see what novelties he can provide at this point.

- Trade balance: Thursday, 12:30. Canada had a wider than expected trade deficit of 2.7 billion in February. A slightly smaller deficit is likely. The trade figures are politically sensitive amid NAFTA talks. US President Trump complains about Canada’s trade surplus with the US.

- Ivey PMI: Friday, 14:00. The Richard Ivey Business School has shown robust growth according to its 175-strong survey with a score of 59.8 points. A small rise to 60.2 is on the cards now. Both figures are substantially above the 50-point threshold separating contraction and expansion.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD stabilized on high ground, trading above the 1.2810 level (mentioned last week).

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far.

1.30 is a round number that is eyed by many. 1.2945 capped the pair in early April. The round 1.2900 level held the pair back in late April.

1.2810 provided support in late March. 1.2760 was a swing high in late February.

1.2665 was a was a double-bottom in November and works as strong support. It is followed by 1.2615, which provided support in November.

Further below, we find 1.2545, the low point in mid-April. Another round of selling may send the pair towards 1.2450, a swing low in mid-February and 1.2290 is next.

I remain bearish on USD/CAD

A comeback in GDP and some USD profit taking could keep things stable. And while a deal on NAFTA is mostly priced in, an announcement could give the loonie a small push to end the week on a positive note.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!