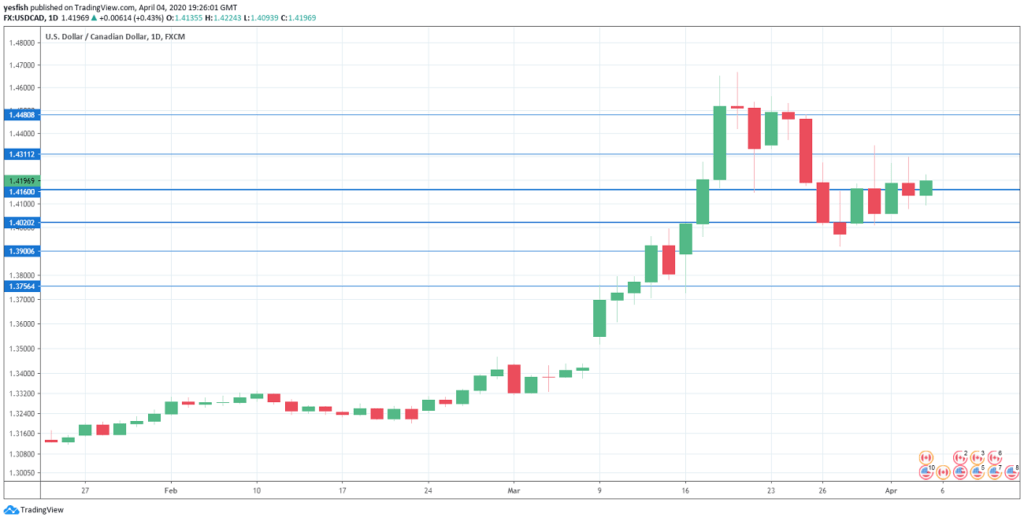

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- BoC Business Outlook Survey: Monday, 14:30. This well-respected survey looks at a wide range of business conditions, including spending and hiring expectations. It should be treated as a market-mover.

- Ivey PMI: Tuesday, 14:00. The PMI slowed to 54.1 in February, down from 57.3 a month earlier. This figure missed the estimate of 55.2 points. The downward trend is expected to continue in March, with a forecast of 50.1, which points to stagnation.

- Housing Starts: Wednesday, 12:15. Housing starts fell to 210 thousand in February, down from 213 thousand in January. This reading missed the forecast of 217 thousand. We will now receive the March data.

- Building Permits: Wednesday, 12:30. Building permits tend to fluctuate widely from month-to-month. In January, the indicator climbed 4.0%, down from 7.4% in the previous release. This figure was much stronger than the estimate of -2.9%. Will we see another gain in February?

- Employment Reports: Wednesday, 13:30. The labor market has been strong, with the economy creating more than 30 thousand jobs in each of the past three months. The upcoming reading may be considerably lower, as the CORVID-19 outbreak has paralyzed the economy. The unemployment rate edged up to 5.6% in February, up from 5.5%. The upcoming releases should be treated as market-movers.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.4480.

1.4310 was tested early in the week.

1.4159 (mentioned last week) remained relevant throughout the week. Currently, it is a weak resistance line.

1.4019 is providing support.

The round number of 1.39 is next. This line has held since mid-March.

1.3757 is the final support level for now.

I remain bullish on USD/CAD

The Canadian dollar reverted to its losing ways last week. The outlook for the currency is bearish, as low oil prices and the economic fallout from COVID-19 have damaged the Canadian economy.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!