Dollar/CAD reacted to positive comments on NAFTA and a gain in Canadian jobs and moved lower. Is it the beginning of a trend or just a short-lived move? Here are the highlights and an updated technical analysis for USD/CAD.

Canada gained 32.3K jobs in March, better than had been expected. More importantly, Canadian Prime Minister Justin Trudeau sounded optimistic on the prospects of reaching a deal on the North American Free Trade Agreement. The breakthrough had already arrived beforehand, with the US dropping a demand for 50% American content in cars, but hearing the optimism from the most senior politician did its magic. The US gained fewer jobs than had been forecast but wage growth ticked up.

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Monday, 12:15. The housing sector has been quite jittery in recent months, with Toronto suffering declines in prices while housing starts are on the rise. After hitting 230K in February, a slide to 220K is on the cards for March.

- BOC Business Outlook Survey: Monday, 14:30. This quarterly report provides an up-to-date view on the economy and it often provides hints for the next moves by the Bank of Canada. The publication back in January preceded the rate hike. This time, the BOC may take a more moderate view, in line with the recent comments by Governor Stephen Poloz, which said that the economy may run before inflation picks up.

- Building Permits: Tuesday, 12:30. The second housing figure for the week also surprised to the upside last time with a rise of 5.6% in January. A more modest figure may be seen for February.

- NHPI: Thursday, 12:30. The New House Price Index disappointed in January by remaining flat. This was the fourth consecutive miss in a row. A small increase in prices may be seen now.

All times are GMT

USD/CAD Technical Analysis

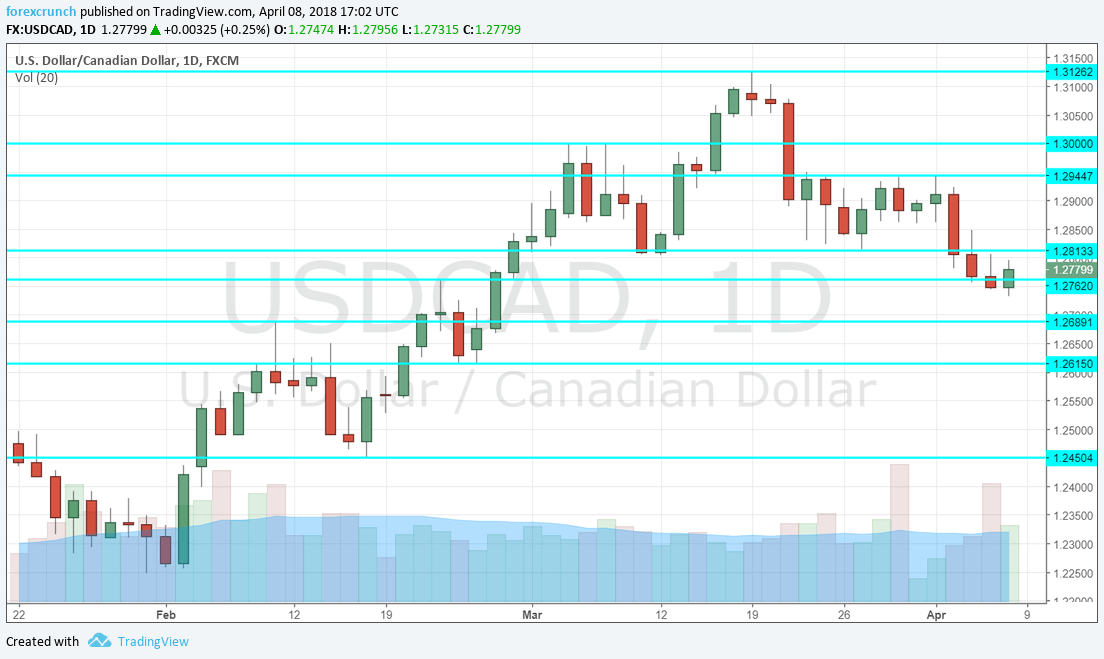

Dollar/CAD made an attempt to move higher but dropped quickly, falling below 1.2760 (discussed last week) at some point before closing a bit higher.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far.

1.30 is a round number that is eyed by many. 1.2945 capped the pair in early April.

1.2810 provided support in late March. 1.2760 was a swing high in late February.

1.2665 was a was a double-bottom in November and works as strong support. It is followed by 1.26, a round number that worked as resistance in October.

I am bullish on USD/CAD

Despite the recovery of the Canadian dollar, the BOC remains cautious and the recent move may prove as a correction. The NAFTA news is now even more priced in than beforehand. In the US, the Fed is leaning towards more rate hikes.

Our latest podcast is titled Volatility venting and Brexit can-kicking

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!