The Canadian dollar had another winning week, as USD/CAD touched a low of 1.3133, its lowest level since January. There are three releases in the upcoming week, including GDP. Here is an outlook at the highlights and an updated technical analysis for USD/CAD.

Canada inflation numbers sagged in July. The headline figure slowed to 0.0%, down sharply from 0.8% beforehand. The core reading fell to -0.1%, down from 0.4% in June. ADP nonfarm payrolls posted a second straight reading above the 1-million mark, with a reading of 1.149 million jobs created. Retail sales sparkled in June, with a gain of 23.7%. The core reading came in at 15.7%. Both indicators improved from the May readings.

In the US, the Empire State Manufacturing Index fell to 3.7, down sharply from 17.2. The Philly Fed Manufacturing index slowed to 17.2, down from 24.1 beforehand. Unemployment claims surprised by climbing to 1.1 million, above the estimate of 930 thousand. The Federal Reserve minutes were dovish. Members stated concern about the continuing adverse impact of Corvid-19 on the US economy. The minutes also reiterated a call from Fed Chair Jerome Powell on the need for a fiscal package from Congress to boost the struggling economy. The week ended with good news from the manufacturing sector, as Manufacturing PMI improved to 53.6, its highest level since February 2019.

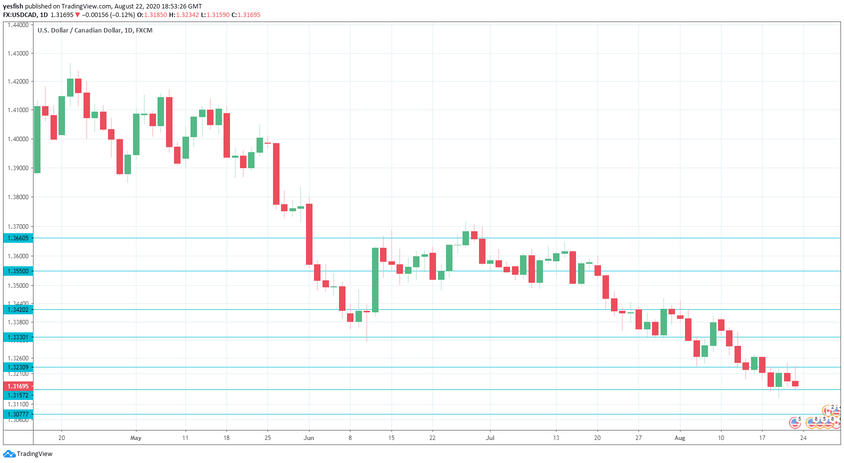

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Corporate Profits: Tuesday, 12:30. This indicator is released each quarter. Corporate profits plunged 38.4% in Q1, reflective the severe economic conditions due to Covid-19. This comes after a modest gain of 3.6% in the first quarter. Will we see an improvement in the first quarter?

- Current Account: Thursday, 12:30. Canada continues to post current account deficits. In the second quarter, the deficit widened to C$-11.1 billion, up from C$-8.8 billion beforehand. The estimate for Q3 stands at C$-11.8 billion.

- GDP: Friday, 12:30. Canada releases GDP on a monthly basis. In May, the economy showed a gain of 4.5%, bouncing back from a sharp decline of 11.6% a month earlier. Another gain is projected for June, with an estimate of 5.2%.

USD/CAD Technical Analysis

Technical lines from top to bottom:

1.3550 (mentioned last week) has held in resistance since mid-July.

1.3420 is next.

1.3330 has held in resistance since August 12.

1.3230 was tested during the week.

1.3118 is the first support line.

1.3078 has provided support since January.

1.2951 is a 52-week low for the pair. It is the final support level for now.

I am bearish on USD/CAD

The Canadian dollar hasn’t sustained a losing week since early July, as the US dollar remains under pressure from the major currencies. With Canada posting some good numbers, the loonie could make further inroads against the US dollar.

Further reading:

Safe trading!