Dollar/CAD continued moving lower as negotiations for a NAFTA deal advanced nicely. The upcoming week features the all-important jobs report. Here are the highlights and an updated technical analysis for USD/CAD.

The Canadian dollar advanced for another week as positive noises were heard it from NAFTA negotiations, even though most of the progress is seen between the US and Mexico. In addition, Canada’s monthly GDP came out at 0.5% in May, significantly above expectations. In the US, the Fed left rates unchanged as expected and upgraded its wording about the economy. The greenback also enjoyed higher yields and good data.

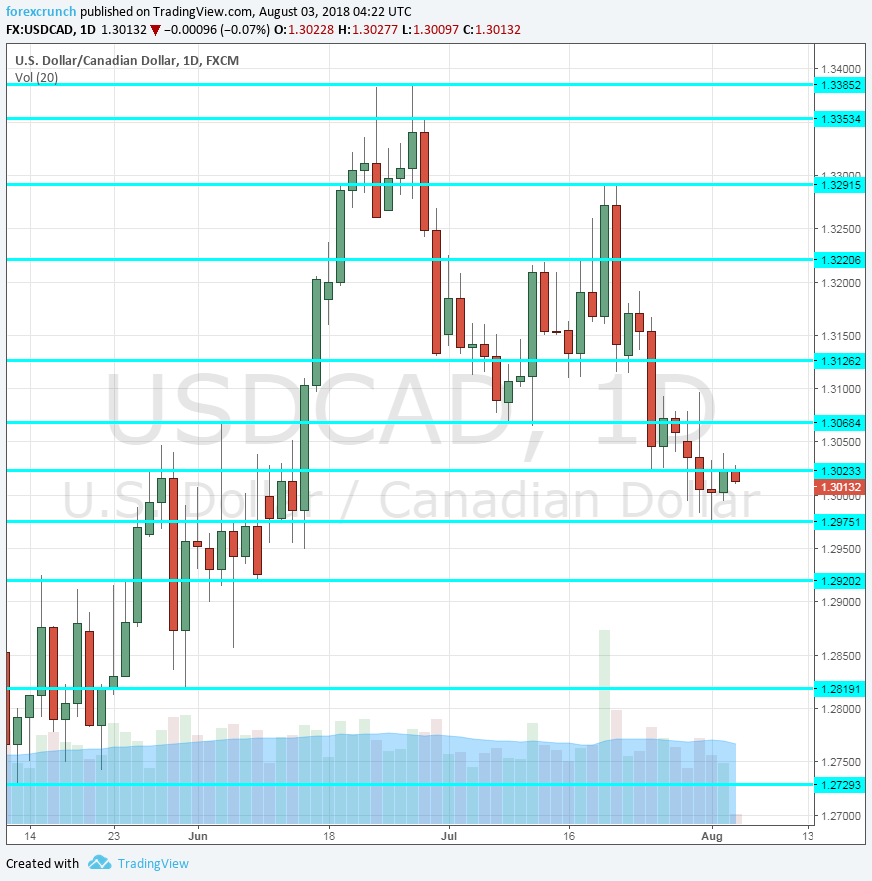

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Tuesday, 14:00. The Richard Ivey School of Business has reported upbeat economic activity according to its forward-looking survey: a score of 63.1 in June. We will now get the data for July.

- Building Permits: Wednesday, 12:30. Canada saw a rise of 4.7% in building consents in May, significantly above expectations and countering a drop beforehand. Another increase is likely in June, thanks to the better weather.

- Housing Starts: Thursday, 12:15. The second Canadian housing figure has also been upbeat in the previous release, with 248K in June, a level unseen for many years. The figure may drop now.

- NHPI: Thursday, 12:30. The New House Price Index is the third and last housing sector measure for the week. Price development disappointed in May by remaining stagnant for a third consecutive month. We may see an increase this time.

- The jobs report Friday, 12:30. Canada enjoyed a bounce back in job growth after two months of declines. The economy gained 31.8K positions in June. The figure for July may be more moderate. The unemployment rate reached 6%. Wages tend to move markets in addition to the employment data. After they jumped by 3.9% in May and supported the C$, a slower pace of 3.5% in June weighed on the currency.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD extended its falls and dipped below the 1.30 level mentioned last week.

Technical lines from top to bottom:

1.3385 was the peak on two occasions in late June. 1.3350 follows close by after serving in both directions in July 2017.

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3125 was a line of support in late June. 1.3065 was a line of support in mid-July. 1.3025 was a swing low in late July.

1.2975 was a low point in early August. Further down, 1.2829 was a stepping stone on the way up in mid-June.

1.2820 was a low point for USD/CAD in early June and the last line, for now, is 1.2730 which supported the pair in May.

I am bearish on USD/CAD

The positive noises on NAFTA, even if Canada does not get everything it wants, could continue supporting the loonie. In addition, the economy is looking good and the jobs report could give the C$ another boost.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!