Dollar/CAD fell as hopes for a NAFTA deal increased. Can CAD continue higher? The turn of the month features the Canadian GDP report. Here are the highlights and an updated technical analysis for USD/CAD.

Canada’s foreign minister Chrystia Freeland and US Trade Representative Robert Lighthizer said that that progress has been made on NAFTA. The hopes of concluding the negotiations in August boosted the loonie. In the US, data was mostly positive, but USD/CAD moved more on trade than on anything else.

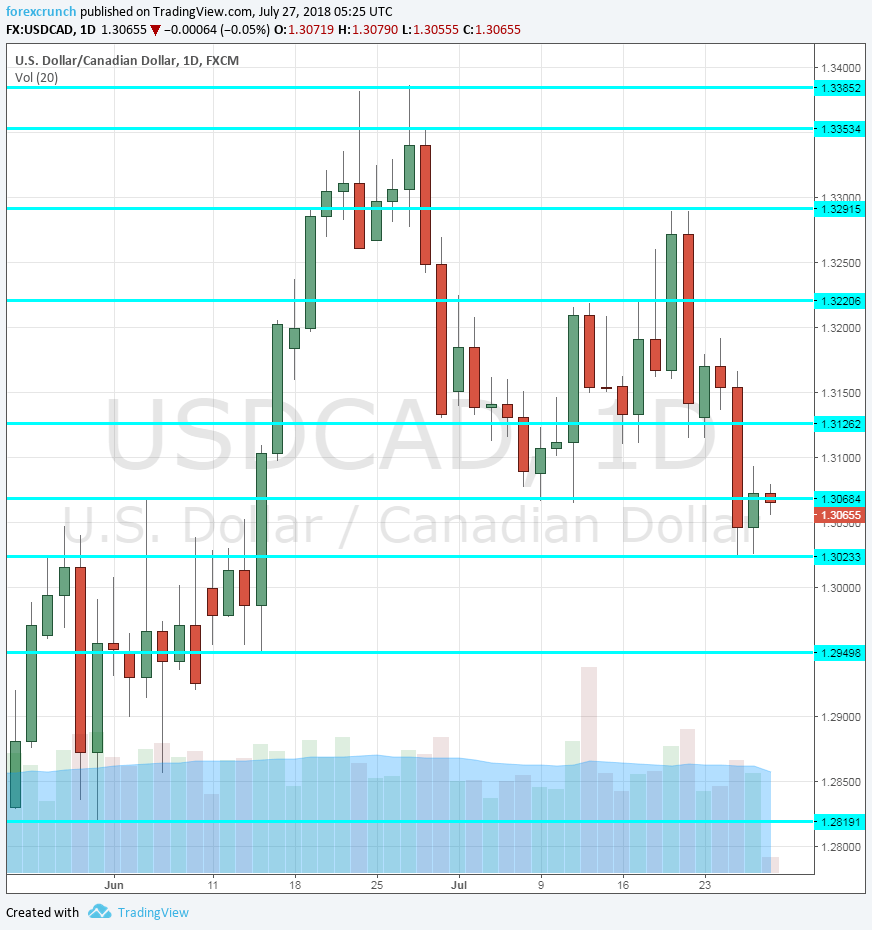

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- GDP: Tuesday, 12:30. The Canadian economy grew by 0.1% in April, showing that growth was relatively slow in the spring after an unimpressive first quarter. The report for May may show a pickup in activity.

- RMPI: Tuesday, 12:30. The Raw Material Price Index reflects inflation in the pipeline. Prices jumped by 3.8% in May, the third consecutive increase. The report for June may not be that great.

- Manufacturing PMI: Wednesday, 13:30. The manufacturing sector has been enjoying steady growth according to Markit’s forward-looking index. The figure increased to 57.1 points in June. We will now the data for July.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD dropped and lost the 1.3125 level mentioned last week.

Technical lines from top to bottom:

1.3795 held the pair down in April. 1.3560 capped the pair back in May 2017 and is a high point.

1.3385 was the peak on two occasions in late June. 1.3350 follows close by after serving in both directions in July 2017.

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3125 was a line of support in late June. 1.3065 was a line of support in mid-July. 1.3035 was a swing low in late July.

1.30 is a round number that is eyed by many. 1.2920 capped the pair in late April and early May as well. 1.2820 served as support in early May.

I am neutral on USD/CAD

Trump’s positive change of heart on NAFTA is certainly good news for the Canadian dollar. However, a hawkish stance by the Federal Reserve could limit any gains

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!