- Housing Starts: Monday, 13:15. Housing starts slipped to 202 thousand in October, down from 222 thousand. Little change is projected for the November reading, with an estimate of 200 thousand.

- Building Permits: Monday, 13:30. This construction indicator tends to show sharp swings, so forecasts often miss their mark. The indicator declined by 6.5% in September, worse than the estimate of -1.9%. Analysts are expecting a rebound in October, with a forecast of +3.5%.

- NHPI: Thursday, 13:30. The New Housing Price Index is a leading indicator of the health of the housing sector. After failing to record a gain for over a year, the index has posted two straight gains. The index gained 2.0% in September and an identical figure is projected for the October release.

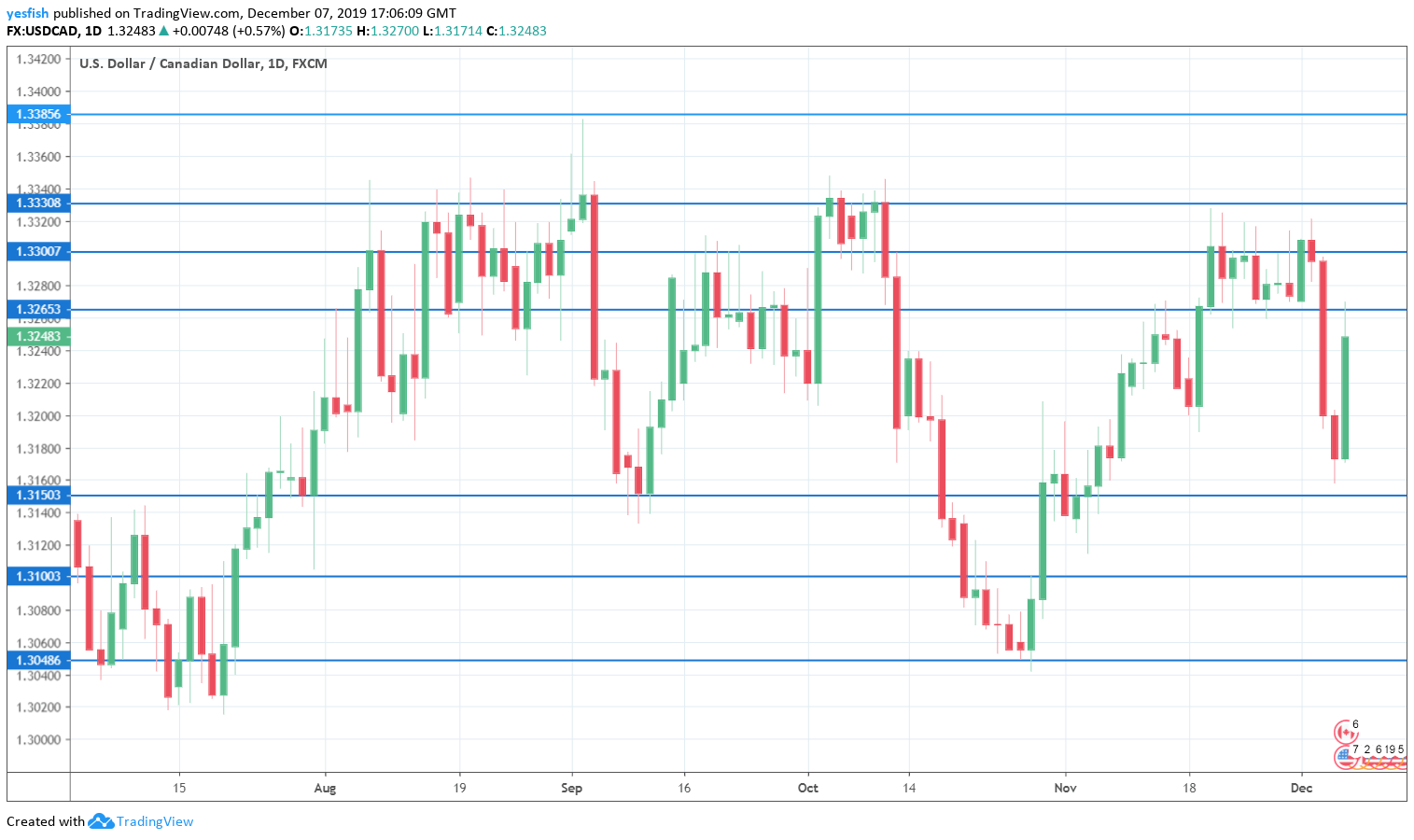

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3660. This is followed by 1.3550.

1.3445 has remained intact since the first week of June. 1.3385 is next.

The round number of 1.3300 remains relevant. It has switched to a support role after losses by USD/CAD this week.

1.3265 is an immediate resistance line that could see further action this week.

1.3150 is next.

1.3100 has held in support since the end of October, when USD/CAD started an extensive rally.

1.3048 is protecting the round number of 1.3000, which has psychological significance.

1.2916 was last tested in October 2018. It is the final support for now.

I am neutral on USD/CAD

The up-and-down trade talks between the U.S. and China have left investors confused, as it remains unclear if the sides are near an interim agreement. Elsewhere, OPEC members have agreed to cut oil production, and higher oil prices could boost the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!