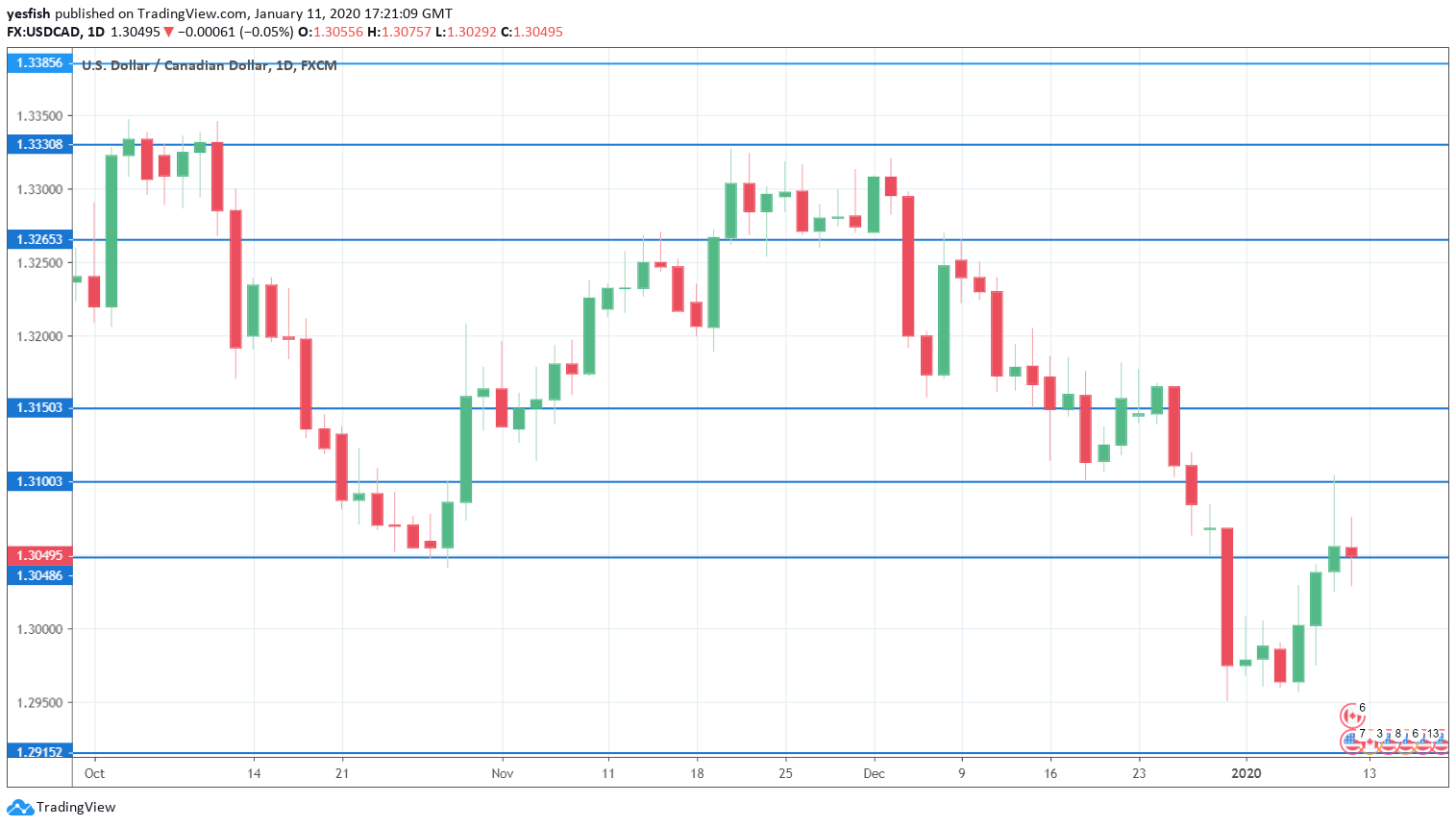

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- BoC Business Outlook Survey: Monday, 15:30. This well-respected survey looks at a wide range of business conditions, including spending and hiring expectations. It should be treated as a market-mover.

- ADP Nonfarm Employment Change: Thursday, 13:30. This employment indicator is pointing to a healthy employment market, with only one decline in the past six readings. After a decline in October, the index rebounded with a strong gain of 30.9 thousand in November. We now await the December release.

- Foreign Securities Purchases: Friday, 13:30. The demand for Canadian securities soared to C$11.32 billion in October, up from C$4.76 billion a month earlier. This marked the largest monthly purchase since February. The uptick is expected to continue in November, with an estimate of C$12.32 billion.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3445, which has remained intact since June 2019. 1.3385 is next.

The round number of 1.3300 has served in a resistance role since early December. 1.3265 follows.

1.3150 switched to a resistance role in the last week of December.

1.3100 (mentioned last week) is an immediate resistance line,

1.3048 is fluid, as the pair ended the week just above this line.

1.2916 has provided support since October 2018. 1.2830 is next.

1.2730 has held in support since May 2018.

1.2630 is the final support level for now.

I remain neutral on USD/CAD

It was a nerve-wracking week for investors, as Iran launched missiles at U.S. bases in Iraq, in retaliation for the killing of an Iranian general by a U.S. missile. However, Iran and the U.S. both indicated that they were looking to de-escalate the situation, and if there are no further clashes, I would expect risk appetite to improve, which would be bullish for the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!