Dollar/CAD enjoyed some volatility, but eventually didn’t go anywhere fast, despite a rate hike. Will NAFTA worries continue holding it back? The upcoming week features the all-important inflation and retail sales numbers. Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada raised rates as expected and also sounded bullish about the economy. However, they repeated one big thing: uncertainty about NAFTA. This concern also weighed on the Canadian dollar, that failed to rally on the good news. The weakness of the US dollar wasn’t really felt in Dollar/CAD, but perhaps the government shutdown could send the greenback to lower ground.

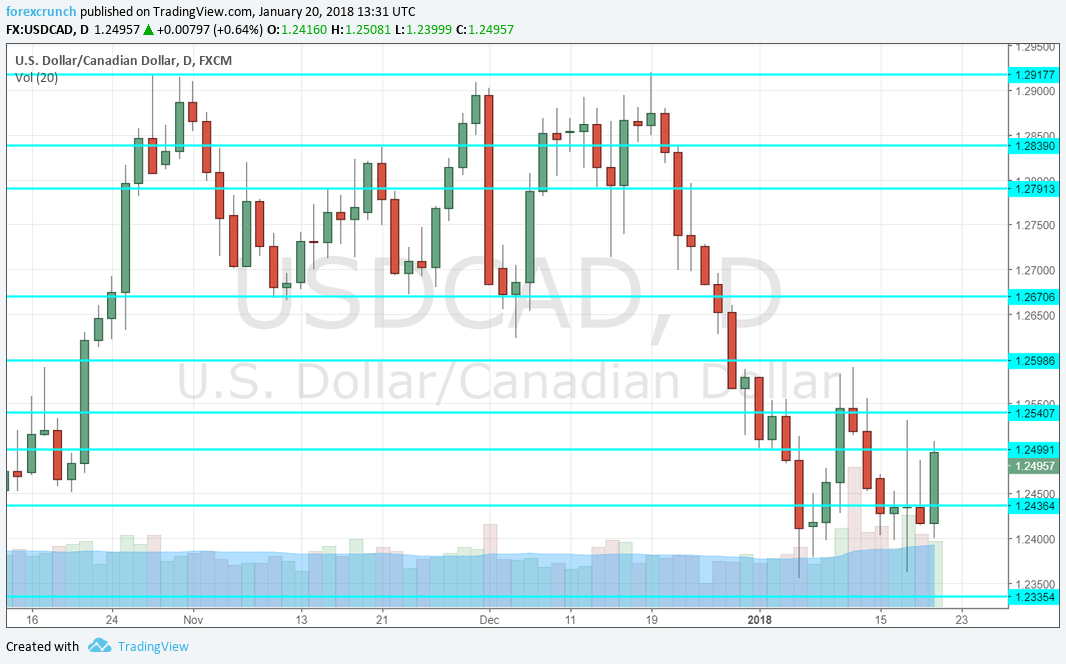

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 13:30. Sales at the wholesale level are watched closely in Canada. They surprised with a jump of 1.5% in October. A more moderate rise of 1% is predicted for November.

- Retail Sales: Thursday, 13:30. The volume of sales also jumped by 1.5% in October, beating expectations and adding to the positive prospects of the economy. Core sales also surprised to the upside with 0.8%. These excellent numbers will probably not be repeated.

- Inflation report: Friday, 13:30. Prices rose by 0.3% in November, more than had been expected. The various core measures published by the BOC also showed advances, vindicating the central bank’s forecasts that inflation would gradually rise. Common CPI stood at 1.5%, the Median CPI reached 1.9%, and the Trimmed CPI stood at 1.8%. Similar figures are likely now.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD traded in the same known ranges. A drop under 1.24 did not reach the 1.2335 trough (mentioned last week).

Technical lines from top to bottom:

1.2920 capped the pair in late October and turned into a double-top in No. It is followed by 1.2840 capped the pair in mid-November and also had a role in the past.

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September and it worked well in January 2018.

Even lower, 1.2260 is a stepping stone on the way down, while strong support only awaits at 1.2070.

I remain bearish on USD/CAD

It is hard to see how the Canadian dollar will be held back for much longer. The rate hike, optimism about the economy, and rising prices of petrol all favor a stronger loonie. The dark clouds of NAFTA uncertainty hold the C$ back, but the energy could eventually be unleashed.

Our latest podcast is titled Oil on a roll and some bitcoin bashing

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!