USD/CAD was almost unchanged last week. There are no releases in the upcoming week. Here is an outlook at the highlights and an updated technical analysis for USD/CAD.

Manufacturing sales plunged 28.5% in April, a new record. This follows a 9.8% drop beforehand, as manufacturing facilities were at limited capacity or shut down due to Covid-19. Consumer inflation bounced back with a 0.3% gain in May, after two straight declines. Still, this missed the forecast of 0.8 percent. Core CPI, which excludes the most volatile items, declined by 0.1 percent. There was positive news on the employment front, as the ADP jobs report indicated that economy added 208.4 thousand jobs in May. The week ended on a sour note, as retail sales plummeted 26.4% in April. The forecast stood at 15.0 percent. The core read declined by 22.0%, compared to the estimate of -12.7 percent.

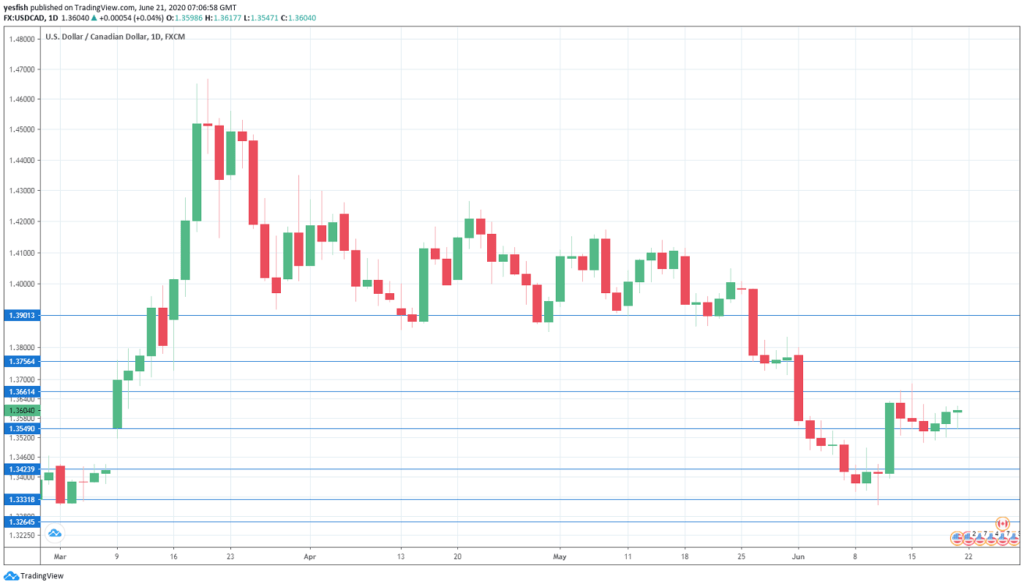

USD/CAD Technical Analysis

Technical lines from top to bottom:

The round number of 1.39 has been a resistance line since late May. 1.3757 is next.

1.3661 (mentioned last week) has some room in resistance.

1.3550 is providing support.

1.3420 is next.

1.3330 was tested last week, for the first time since March.

1.3265 is the final support level for now.

I am neutral on USD/CAD

The Canadian economy has been hit hard by Corvid-19 and is very dependent on the U.S. economy, which is also struggling. As a minor currency, the Canadian dollar remains vulnerable due to the severe economic conditions. Still, the currency is up 3.1% against the U.S. dollar in the second quarter.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!