The Canadian dollar reversed directions last week, as USD/CAD gained over one percent. There are five releases in the upcoming week, including inflation and retail sales. Here is an outlook at the highlights and an updated technical analysis for USD/CAD.

Housing starts rose to 193 thousand in May, up from 173 thousand beforehand. This beat the estimate of 160 thousand. Corporate profits sunk in Q1, with a sharp decline of 38.4 percent. This followed three straight quarters of growth.

In the U.S., consumer inflation posted a third consecutive decline, as the weak economy isn’t generating any inflation. Both the headline and core figures came in at -0.1%. The Fed made no change to the benchmark rate and indicated that it has no plans to alter rates from their ultra-low levels prior to 2022. Producer Price Inflation numbers were a mix. The headline read gained 0.4%, while the core figure fell by 0.1 percent. Unemployment claims continue to ease, falling to 1.54 million last week, down from 1.87 million beforehand.

- Manufacturing Sales: Monday, 12:30. Manufacturing sales plunged 9.2% in March, as the Covid-19 outbreak hurt the manufacturing sector. This figure was well below the forecast of -4.4 percent. We now await the April data.

- Foreign Securities Purchases: Tuesday, 12:30. Demand for domestic securities by foreigners declined by C$9.7 billion in March, after a strong gain of C$20.6 billion beforehand. Will we see a rebound in April?

- Inflation: Wednesday, 12:30. Inflation has headed south, with back-to-back declines. In April, CPI fell by 0.7%, within expectations. A strong rebound is expected in May, with an estimate of 0.8 percent. Core CPI, which excludes the most volatile items, slipped by 0.4% in March, after three consecutive declines.

- ADP Non-Farm Employment: Thursday, 12:30. The economy created 289 thousand jobs in May, defying the analysts, who had projected a loss of 500 thousand jobs. Will ADP nonfarm payrolls also rebound with a strong release?

- Retail Sales: Friday, 12:30. Retail sales is the primary gauge of consumer spending. The headline read sank in March, with a 10% decline. Core retail sales, which excludes the most volatile items, has been steadier. The indicator declined by 0.4% in March, its lowest level in five months.

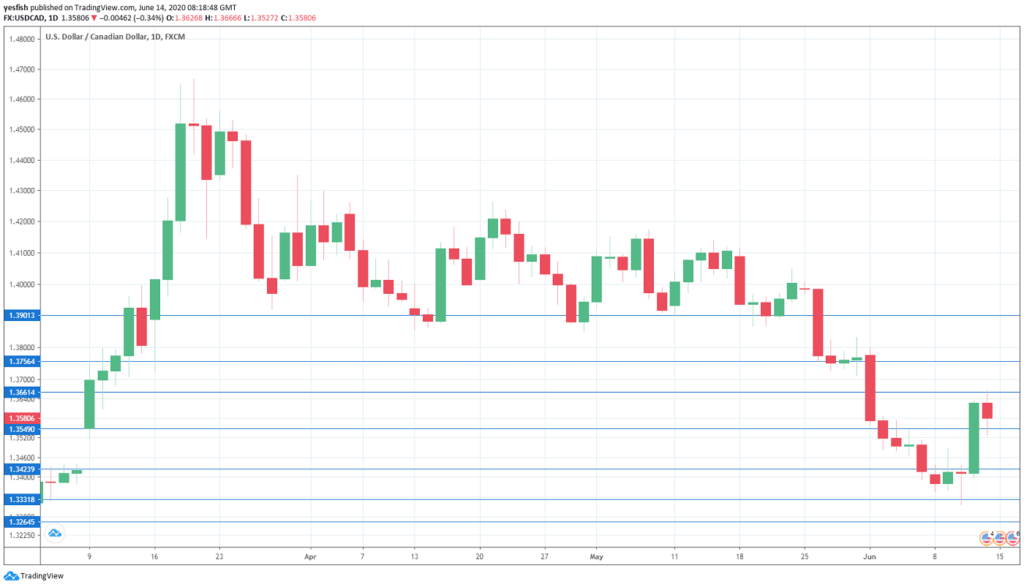

USD/CAD Technical Analysis

Technical lines from top to bottom:

The round number of 1.39 has been a resistance line since late May. 1.3757 is next.

1.3661 (mentioned last week) was tested late in the week.

1.3550 remains relevant and switched to a support role last week. It is a weak line.

1.3420 is next.

1.3330 was tested in support last week.

1.3265 is the final support level for now.

I am neutral on USD/CAD

The Canadian dollar has showed surprising resilience in recent months. The Canadian economy is slowly showing signs of recovery but investors will be cautious before putting their faith in minor currencies like the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!