Dollar/CAD had a massive turnaround, reaching new highs before turning sharply lower. Will it continue falling? GDP is the primary event in a light week leading into Easter. Here are the highlights and an updated technical analysis for USD/CAD.

Everything went in favor of the Canadian dollar: the US removed a key demand that blocked the NAFTA negotiations, the Federal Reserve made a dovish hike (no upgrade in the dot-plot), oil prices went higher and last but not least, inflation is on the rise in Canada. Together with the official exemptions from steel and aluminum tariffs from its southern neighbor, USD/CAD made a huge turn.

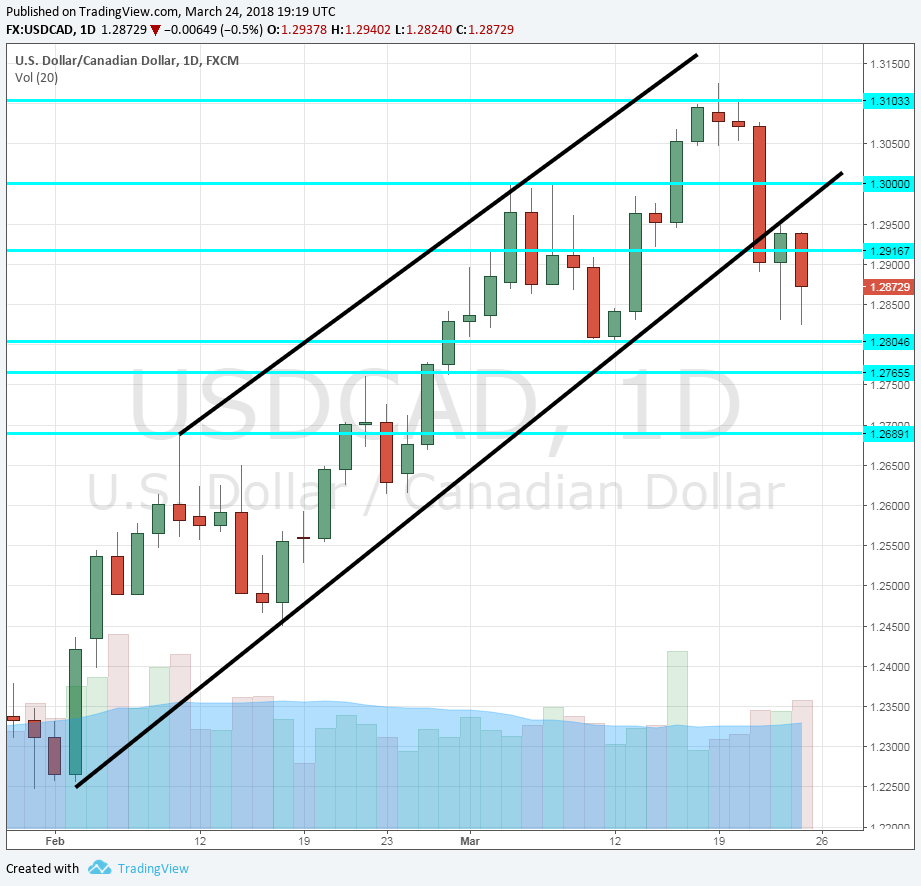

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Thursday, 12:30. Canada will now report the first monthly estimate for 2018. In December, the economy grew by 0.1% and a similar figure is likely now as well. Contractions on a monthly basis are not rare but will cause worries.

- RMPI: Thursday, 12:30. The Raw Materials Price Index rose by 3.3% last time, supporting the Canadian dollar. The country’s commodity exports, mostly oil, are key to the economy. The Industrial Product Price Index (IPPI) rose by 0.3% last time.

All times are GMT

USD/CAD Technical Analysis

Dollar/CAD initially broke above 1.31 (mentioned last week). but then turned south. On the way, it broke below the uptrend support line.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.31 is a round number and immediate resistance.

1.30 is a round number that is eyed by many. 1.2920 was a triple top in late 2017 and switches positions.

1.2790 was high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

I am neutral on USD/CAD

In the short run, the American focus on China is a relief for Canada, but in the longer run, trade wars are not good news for Canada. The pair may stabilize after the recent moves.

Our latest podcast is titled Fed Day and Underwhelming Oil

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!