Dollar/CAD continued advancing as Trump’s tariffs caused great concern in Canada. What’s next? The all-important BOC decision and the jobs report stand out. Here are the highlights and an updated technical analysis for USD/CAD.

Donald Trump imposed tariffs of 25% on steel and Canada sends most of its steel to the US. The Administration clarified that Canada would not be exempt and Trump added fuel to the fire by conditioning an exemption on a successful NAFTA accord. This has dealt a blow to the C$. Canadian GDP came out at 0.1% m/m as expected. In the US, Fed Chair Jerome Powell hinted at an additional rate hike in 2018, but the trade issues trumped everything else.

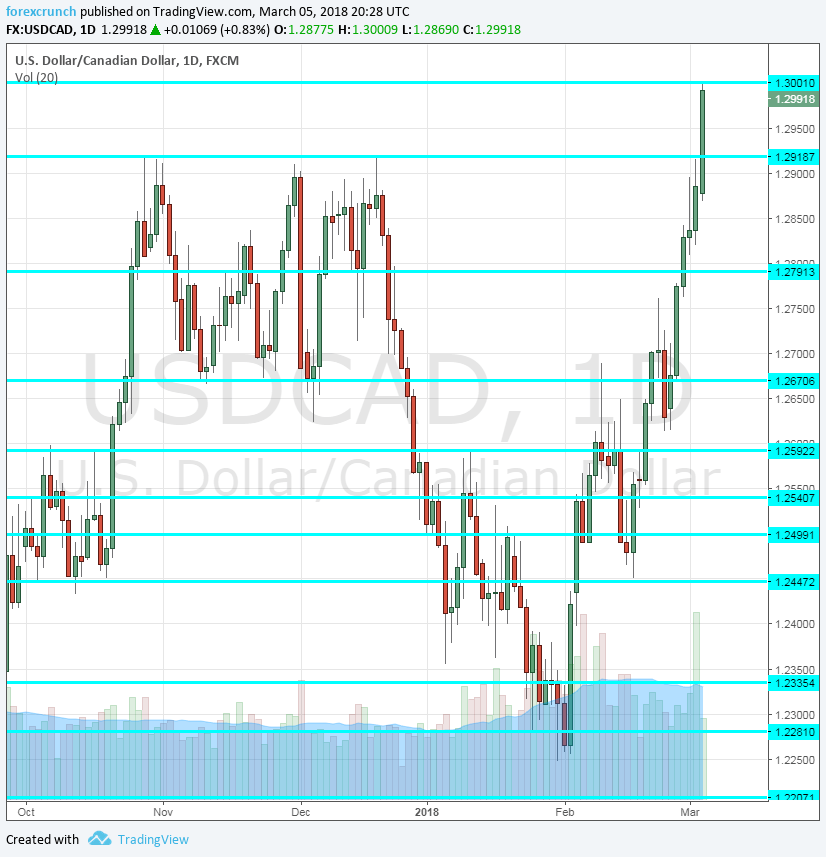

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Tuesday, 15:00. The Richard Ivey Business School publishes its highly regarded purchasing managers’ index. A small rise from 55.2 to 56.3 points is expected. Note that the indicator is volatile.

- Trade Balance: Wednesday, 13:30. Canada had a wide trade deficit of 3.2 billion back in December, extending its previous deficits. Another one is likely for January.

- Labor Productivity: Wednesday, 13:30. The level or productivity is another measure of the economy, yet falling productivity, as was the case in Q3 2017, is inflationary, therefore positive for the currency. A rise may be seen now.

- Rate decision: Wednesday, 15:00. The Bank of Canada raised the interest rate in January after two excellent jobs reports, but things have changed since then. Canada saw a big drop of 88K jobs in January and the retail sales report was quite worrying. Moreover, the recent tariffs imposed by Trump are very damaging to Canada. the BOC has already expressed concerns over NAFTA and immediate tariffs on steel will have another chilling effect. The team led by Stephen Poloz may even hint that rate cuts are possible.

- Housing Starts: Thursday, 13:15. The number of housing starts slipped to 216K in January, slightly better than 211K that was expected. We could see another rise this time.

- Building Permits: Thursday, 13:30. Building permits have jumped by 4.8% back in December, beating expectations. However, it is important to note that this figure is volatile. We could see a drop in January.

- NHPI: Thursday, 13:30. The New Home Price Index is watched in order to see any significant changes amid worries about the housing markets in Toronto and Vancouver. The release disappointed in the past three months, falling short of expectations. It remained flat in December. A minor rise may be seen for January.

- Stephen Poloz speaks Thursday, 16:00. The Governor of the Bank of Canada will unveil a new C$10 note in Halifax, Nova Scotia. His remarks may also touch on monetary policy.

- Timothy Lane speaks,Thursday, 20:35. The Deputy Governor of the BOC speaks in Vancouver and is likely to refer to monetary policy, commenting on the decision taken the previous day.

- Jobs report: Friday, 13:30. Canada saw a fall of 88K jobs in January after two months of around 79K each month. This time, a more modest gain is likely, around 68K. The unemployment rate, which stood at 5.9%, may slide back to 5.8%. Note that wages are also becoming important in Canada after they rose by 3.3% y/y, better than in the US.

All times are GMT

USD/CAD Technical Analysis

Dollar/CAD made a move to the upside, falling short of the triple-top of 1.2920 (mentioned previously). However, the pair made a hsarp move higher in the wake of the new week, flirting with 1.30.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3080 is the extension of the move from 1.2920 to 1.30.

1.30 is a round number that is eyed by many. 1.2920 was a triple top in late 2017 and switches positions.

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.25 remains a battleground. 1.2450 served as support in February. 1.2335 gave support to the pair in late September and it worked well in January 2018.

I remain bullish on USD/CAD

With trade tensions only worsening, overbought conditions do not play a role. Moreover, the BOC may react by pushing the Canadian dollar even lower.

Our latest podcast is titled The Powell Power Play.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!