- Manufacturing PMI: Monday, 14:30. The index has hovered just above the 50-level in the past two readings, which separates contraction from expansion. This points to stagnation in the manufacturing sector. We now await the February release.

- BoC Rate Decision: Wednesday, 15:00. The BoC has kept the benchmark rate pegged at 1.75% since October 2018 and no change is expected at the upcoming meeting. The tone of the rate statement could affect the movement of USD/CAD.

- Employment Data: Friday, 13:30. The labor market has looked strong, with the economy creating more than 34 thousand jobs in each of the past two readings. The unemployment rate dropped to 5.5% in January, down from 5.7%. The upcoming employment data could have a significant impact on the movement of USD/CAD.

- Trade Balance: Friday, 13:30. Canada continues to record trade deficits. In December, the trade deficit fell to C$0.4 billion, down from C$1.1 billion a month earlier. This marked the smallest deficit since June. Will we see a surplus in the January release?

- Ivey PMI: Friday, 15:00. The index jumped to 57.3 in January, well above the estimate of 52.3. Will the upswing continue in February?

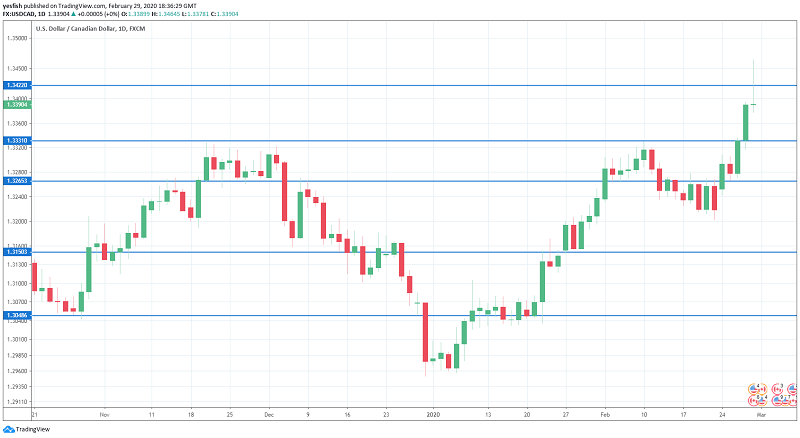

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3660, which held since December 2018. 1.3550 is next.

1.3420 has remained intact since June 2019.

1.3330 has switched to support for the first time since December, after strong gains by USD/CAD last week.

1.3265 is next.

1.3150 has strengthened in support.

1.3100 (mentioned last week) is the next support level.

1.3048 is protecting the symbolic 1.3000 level. It is the final support level for now.

I remain bullish on USD/CAD

Investor risk appetite remains weak as the coronavirus has now spread to Europe and the United States. This means that minor currencies like the Canadian dollar are likely to remain under pressure.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!