- GDP: Wednesday, 9:00. Canada publishes GDP reports on a monthly basis. The economy slowed to just 0.1% in November, down from 0.7% beforehand. We now await the December data.

- RMPI: Thursday, 7:00. The Raw Materials Price Index rose to 5.7% in January, up from 3.5%, as inflation continues to pick up speed. Will the upswing continue in February?

- Building Permits: Thursday, 9:00. Building Permits tends to show sharp swings. The indicator jumped 8.2% in January after a reading of -4.1% beforehand. Will we see another gain in February?

- Manufacturing PMI: Thursday, 9:00. The manufacturing sector continues to show expansion and the PMI rose to 54.8 in January, up from 54.4 beforehand. We now await the February release.

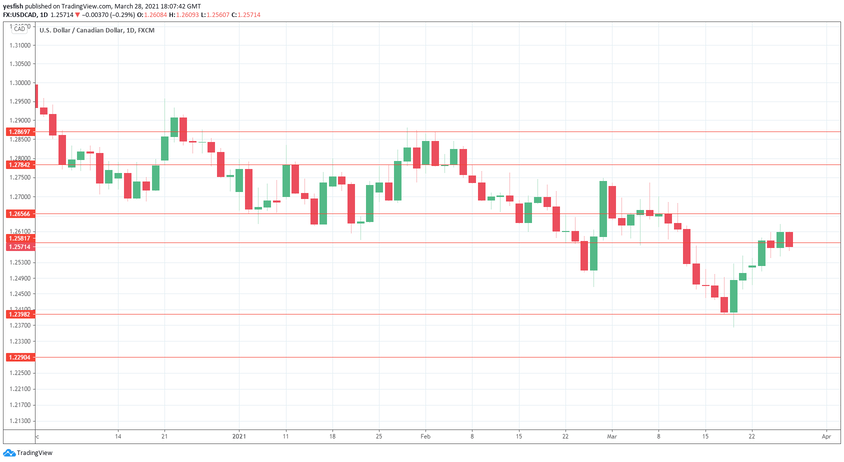

Technical lines from top to bottom:

We start with resistance at 1.2869 (mentioned last week).

1.2784 is next.

1.2656 switched to resistance in mid-March, when CAD started a strong rally.

1.2581 is an immediate resistance line.

1.2398 is the first level of support.

1.2290 is the final support level for now.

.

I am neutral on USD/CAD

The Canadian dollar has been stabilized after getting a boost from the recent rise in oil prices. The US recovery continues to show signs of strengthening, which is bullish for the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!