In the US, manufacturing activity grew at a slower pace in April, as the ISM Manufacturing PMI dropped to 60.7, down from 64.7. It was a similar story for business activity, as the ISM Services PMI slowed to 62.7, down from 63.7. Both PMIs missed their estimates.

The market was ready to celebrate a massive nonfarm payroll report for April, with an estimate of 990 thousand. Some analysts had even predicted a print of two million, but in the end, the economy created just 266 thousand jobs. Unemployment rose to 6.1%, up from 5.8% and above the estimate of 6.0%. There was a silver lining, as wage growth climbed 0.7%, rebounding from -0.1% and above the forecast of 0.0%.

- Manufacturing Sales: Friday, 12:30. Manufacturing sales took a downturn in February, with a read of -1.6%. Will we see an improvement in the March data?

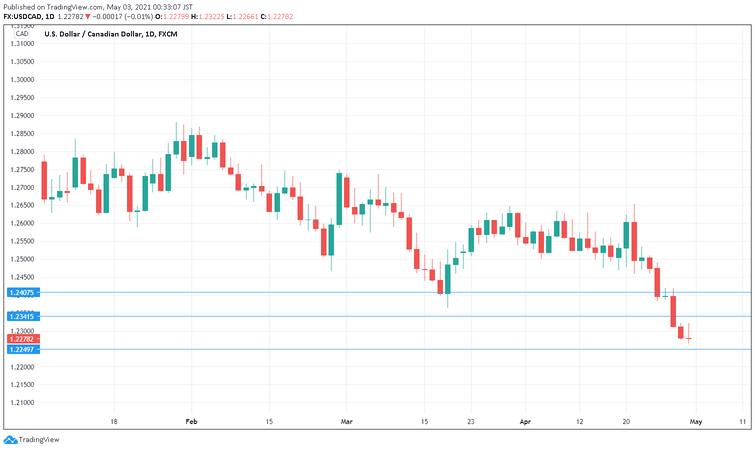

Technical lines from top to bottom:

We start with resistance at 1.2446 (mentioned last week).

1.2350 is next.

1.2210 has switched to resistance after sharp losses by USD/CAD last week.

1.2125 is an immediate resistance line.

1.1985 is providing support.

1.1765 is the final support line for now.

I am bullish on USD/CAD

Canada’s weak job numbers last week are an indication that the recovery from Covid is not nearly complete, and this could curb appetite for the Canadian dollar.

Follow us on Sticher or iTunes

Further reading:

-

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe Trading!