In the US, the Philly Fed Manufacturing Index slowed to 31.5, down sharply from 50.2 and shy of the forecast of 40.8. Unemployment claims fell for a third straight week, coming in at 444 thousand versus 478 thousand a week earlier. The Manufacturing PMI was up slightly to 61.5, above the forecast of 60.0. The Services PMI sparkled with a read of 70.1, as the business sector showed unprecedented growth. This beat the estimate of 64.3. The 50-level separates expansion from contraction.

- Corporate Profits: Tuesday, 12:30. Corporate Profits posted a gain of 7.9% in Q4, after a sizzling gain of 44.9% in the third quarter. We now await the first-quarter data.

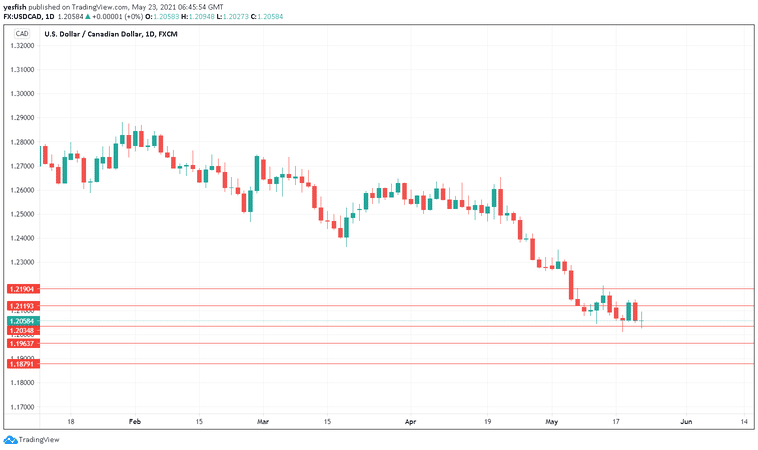

Technical lines from top to bottom:

1.2350 has held since late April.

1.2275 (mentioned last week) is next.

1.2119 has some breathing room as resistance.

1.2034 is an immediate line of support.

1.1963 follows.

1.1875 is the final line of support for now.

I remain bearish on USD/CAD

The Canadian dollar has not posted a losing week since March, and rising commodity prices is contributing to a stronger Canadian dollar. We could see CAD attempt another break of the symbolic 1.20 line this week.

Follow us on Sticher or iTunes

Further reading:

-

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe Trading!