Dollar/CAD chopped around in familiar ranges as NAFTA headlines went in all directions. What’s next? The BOC rate decision and GDP stand out. Here are the highlights and an updated technical analysis for USD/CAD.

NAFTA negotiations saw hopeful hints from Trump and some optimism from Canadian representatives but also talk about a small version of the deal. In addition, the Trump Administration is studying imposing tariffs on cars, which is not exactly a trade-friendly move. The Canadian Dollar jumped up and down. Canadian Wholesale Sales rose by 1.1%, better than expected. The US Federal Reserve basically said it would raise rates in June but may take a pause afterward. All in all, it was a mixed week.

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Current Account: Wednesday, 12:30. Canada had a current account deficit of 16.3 billion in the last quarter of 2017 but this was lower than expected and below the figures in the previous quarter. A wider deficit may weigh on the C$ and that is what is expected: 18.2 billion this time.

- RMPI: Friday, 12:30. The Raw Material Price Index (RMPI) is important for Canada and its raw material exports, namely tar sands oil. A rise of 2.1% was recorded in March and a more modest change could be seen in April. The Industrial Product Price Index advanced by 0.8% last time.

- Rate decision: Wednesday, 14:00. The Bank of Canada left its interest rate unchanged in the April decision. While they left the hawkish bias, the tone was cautious. Since then, several figures came out below expectations. The BOC is therefore expected to leave the Overnight Rate unchanged at 1.25% and refrain from hinting that a hike is coming in the July meeting.

- GDP: Thursday, 12:30. Canada is special in publishing Gross Domestic Product figures on a monthly basis. This publication is for the month of March, the last one for the first quarter, thus making it more important. The economy grew by 0.4% in February and probably slowed down in March: 0.2% is expected. The annualized figure is also of interest.

- Sylvain Leduc talks: Thursday, 16:20. The Deputy Governor of the BOC will speak in Quebec City and may add additional explanations to the fresh decision by the central bank.

- Manufacturing PMI: Friday, 13:30. Markit’s manufacturing purchasing index for the manufacturing sector stood at 55.5 points in April, similar to previous levels and reflecting OK growth. No big changes are likely now.

*All times are GMT

USD/CAD Technical Analysis

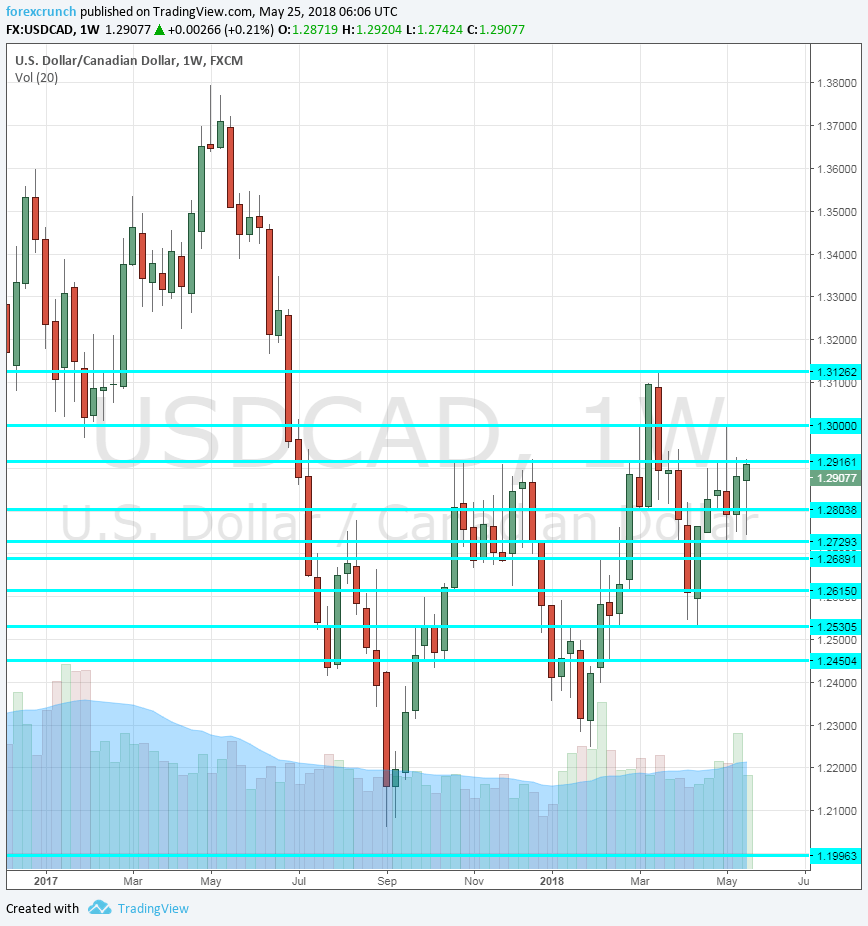

Dollar/CAD traded between 1.2750 and 1.2920 (mentioned last week) attempting to push higher toward the end of the week.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far.

1.30 is a round number that is eyed by many. 1.2920 capped the pair in late April and early May as well. 1.2810 served as support in early May.

1.2730 was a swing low seen mid-May. It is followed by 1.2690 which was a swing high back in February. Further down, 1.2615 and 1.2535 where the top and bottom of a range seen in early April.

I am bullish on USD/CAD

Trump is becoming more hostile on trade, and this could hit the loonie harder. In addition, the BOC will likely remain dovish.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!