Dollar/CAD dropped sharply on the deal between the US and Canada and also the weakness of the US Dollar but bounced back towards the end of the week. What’s next? Canada’s jobs report stands out. Here are the highlights and an updated technical analysis for USD/CAD.

The US and Mexico struck a deal and Canada is set to join. The C$ advanced on the news, even though Canada may eventually be excluded from the deal. The greenback suffered general losses as markets remained optimistic but the mood soured towards the end of the week. Canada is set to make concessions in order to secure a deal.

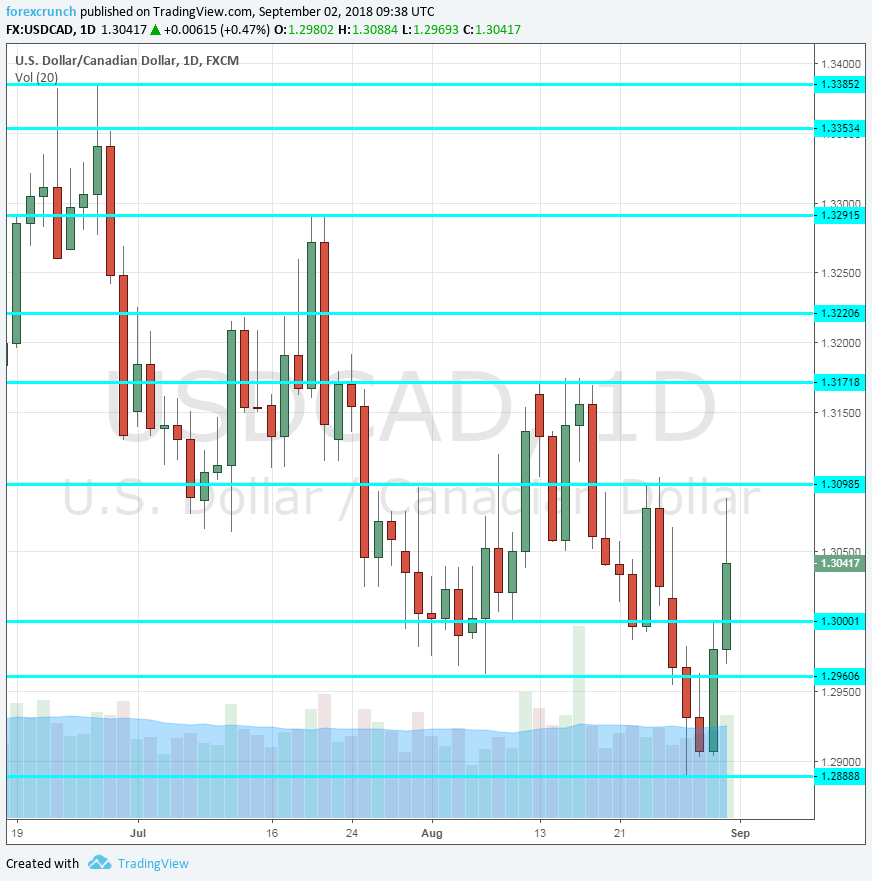

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Markit’s manufacturing purchasing managers’ index for Canada came out at 56.9 points in July, reflecting good, yet not outstanding growth levels in the sector. A better number could be seen now, on optimism for a NAFTA deal.

- Trade Balance: Wednesday, 12:30. Canada had a smaller trade deficit than expected in June, only 0.6 billion. We may see a narrower deficit this time. Trade data is politically sensitive amid trade talks.

- Labor Productivity: Wednesday, 12:30. Productivity growth is problematic in many developed economies. Canada’s figures dropped by 0.3% in Q1 after a fall beforehand. The see-saw may continue: an increase of 0.2% is projected now.

- Rate decision: Wednesday, 14:00. The Bank of Canada raised the interest rate in its July meeting, as they had telegraphed well in advance. The surprise back then was that they maintained their hawkish bias, despite repeatedly warning about the uncertainty resulting in US tariffs. This time, Governor Poloz and his colleagues are unlikely to move on the rates, leaving it to a meeting that also consists of a press conference. Nevertheless, they will express themselves in the statement which will likely discuss trade and also recent GDP numbers.

- Building Permits: Thursday, 12:30. The housing sector has seen some rocky times, with soaring prices hit by regulation. A drop of 2.3% was recorded in June. July could see a bounce back.

- Carolyn Wilkins talks: Thursday, 18:30. The Bank of Canada Deputy Governor will speak in Regina and may provide additional information to the BOC’s statement. That would come in handy as there is no press conference.

- Jobs report: Friday, 12:30. Canada reported a whopping gain of 54.1K jobs in July, but this concealed a loss of full-time jobs and a leap in part-time jobs. In addition, wages disappointed by reverting back down after two good months. The unemployment rate stood at 5.8%. In August, we can expect a more modest increase in positions. A rise of 5.1K jobs is on the cards and the unemployment is forecast to rise to 5.9%.

- Ivey PMI: Friday, 14:00. The Richard Ivey Business School showed impressive optimism about the economy. The score of 61.8 in July reflects robust growth. A small rise to 62.3 is on the cards.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD dropped sharply, falling below the 1.2960 level (mentioned last week).

Technical lines from top to bottom:

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3170 served as resistance in mid-August. 1.3100 is a round number that also capped the pair several times in August.

Below 1.3000 we find the mid-August trough of 1.2960. 1.2890 is the initial low seen in late August.

1.2820 was a stepping stone on the way up in late May. 1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

I am neutral on USD/CAD

Almost everything depends on a NAFTA deal. The level of uncertainty is very high, leaving room for anything to happen.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!