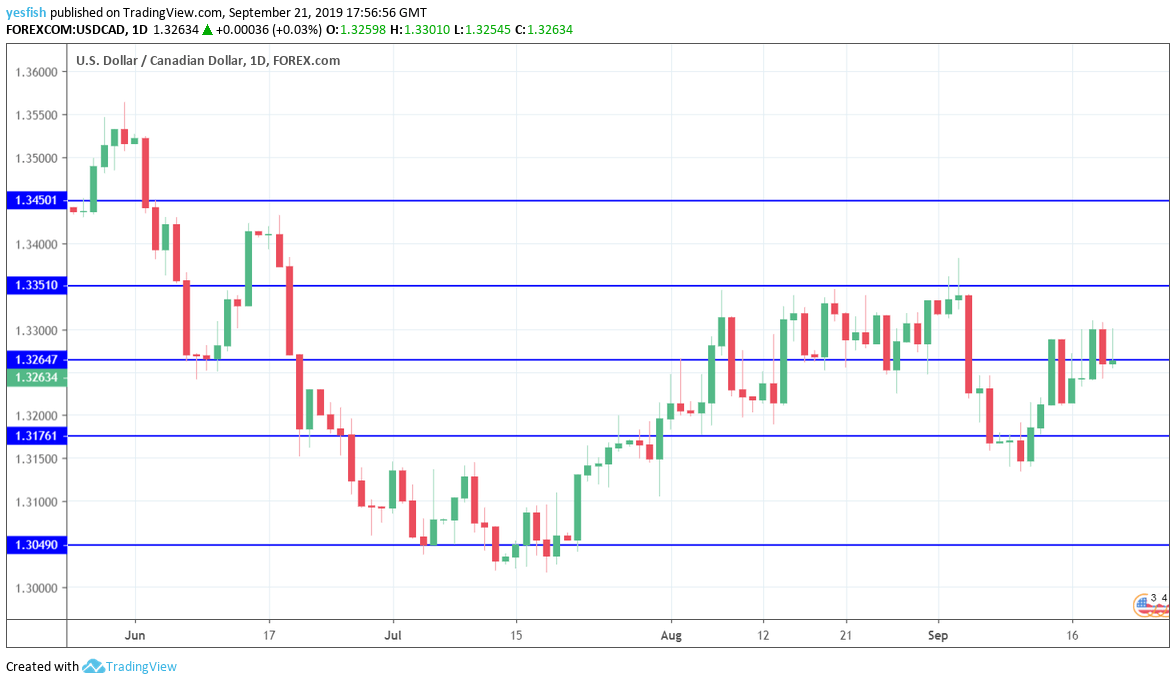

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. Wholesale Sales have been quite erratic, resulting in estimates that are often well off the mark. In June, the indicator gained 0.6%, well above the estimate of -0.2%. The markets are expecting a drop to zero in July.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3630. 1.3565 is next.

1.3445 has held in resistance since the first week of June. This is followed by 1.3385.

1.3350 is the next resistance line.

1.3265 was active throughout the week. USD/CAD ended the week just below this line.

1.3175 is providing support.

1.3125 (mentioned last week) is next. It has provided support since the end of July.

1.3048 is protecting the round number of 1.3000, which has psychological significance.

1.2916 has held firm since October.

1.2830 is the final support line for now.

I remain bullish on USD/CAD

The surge in oil prices this week is indicative of rising tensions in the Persian Gulf, and any further ominous developments could quickly dampen risk appetite and hurt minor currencies like the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!