- Fed officials were quite hawkish at the last Fed meeting.

- Policymakers expect the Fed target rate at 4.50%-4.75% by the end of 2023.

- US PPI came in higher than expected, pointing to still-high inflation.

Today’s USD/CAD outlook is bullish as the dollar soars on hawkish FOMC meeting minutes. To lower inflation from 40-year highs, Fed officials increased interest rates by 75bps at their meeting last month.

-If you are interested in forex day trading then have a read of our guide to getting started-

According to the FOMC meeting minutes, many Fed members “emphasized the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.”

According to predictions made by policymakers at the meeting last month, the Federal Reserve’s target policy rate, presently in the range of 3.00%-3.25%, is expected to rise to the range of 4.25%-4.50% by the end of this year and end at 4.50%-4.75% by the end of 2023.

Financial markets, which for much of the year had held to the belief that the Fed would soon reverse course and drop rates in the face of slowing growth and rising unemployment, have reached a turning point in recent weeks. Fed officials have stated that they anticipate keeping rates high once they have completed raising them.

The dollar appreciated further versus the Canadian dollar on the back of data showing that US producer prices rose more than anticipated in September, pointing to still-high inflation.

USD/CAD key events today

The US Consumer Price Index will be released later today. Investors will pay attention to the change in consumer goods and services prices as it will indicate the state of inflation in the country.

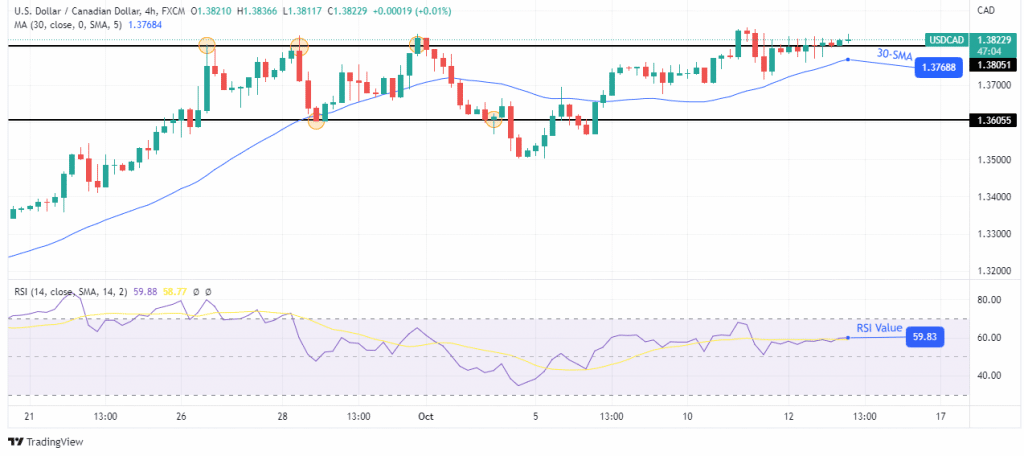

USD/CAD technical outlook: Bulls struggling to find footing above 1.3805

The 4-hour chart shows the price trading above the 30-SMA and the RSI above 50. Although the trend is bullish, it is clear that bulls are struggling. The 1.3805 key resistance level is proving quite difficult to break. This can be seen in how the price makes small-bodied candles at the level.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

If bulls cannot gather enough momentum to push the price far above this level, it might fall below the 30-SMA. If this happens, bears will be confident enough to retest 1.3605 as support and possibly start making lower lows and lower highs.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.