- USD/CAD cracks above 1.2800 as US dollar gains across the board.

- The tapering clues in FOMC meeting minutes have provided massive strength to the Greenback.

- Weakening oil prices add more fuel to the bulls.

- Canadian ADP report came better than expected but could not provide any support to the CAD.

The USD/CAD price analysis reveals a highly bullish scenario as the US dollar gains strongly and oil prices weaken to three-month lows.

The USD/CAD pair is trading at 1.2808, 1.24% up on Thursday, while writing.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

A bullish consolidation phase seems to be underway, with the USD/CAD pair hovering around the recent monthly highs above 1.2800.

Since bouncing off the psychological 1.2500 level on Monday, the pair gained momentum for the fourth day in a row. The USD/CAD pair climbed to its highest level since July 20 due to various factors working together.

The Fed may eliminate the stimulus created during the crisis, as investors now appear to be convinced. In addition, policymakers noted that progress has been made in achieving maximum employment and price stability, according to the minutes released Wednesday.

Combined with the risk-averse environment and expectations that the Fed would reduce bond purchases shortly, the US dollar touched multi-month highs as a safe haven. Therefore, this was seen as one of the major factors behind the rise of USD/CAD.

The US dollar has maintained its buying tone in the recent North American session despite mixed US macroeconomic releases. For example, while weekly US jobless claims decreased from 377,000 to 348,000, the Philadelphia Fed Manufacturing Index fell from 21.9 to 19.4 in August.

Nevertheless, the commodity-linked Loonie was offset amid a further decline in crude oil prices. Oil prices fell to a nearly three-month low because of concerns that the rapidly spreading delta variant of Coronavirus could stunt the global economic recovery.

In its monthly report released on Thursday, the ADP Research Institute reported that private-sector employment rose 221,300 in July compared to June. In the previous reading, it was reported as -106,200 (revised from -294,200). However, the positive data could not lend any significant support to the Canadian dollar.

Although the fundamental background remains favorable to bullish traders, it does not indicate that the recent growth will continue. This means a significant decline can be viewed as a buying opportunity or at least be limited temporarily.

–Are you interested to learn more about forex signals? Check our detailed guide-

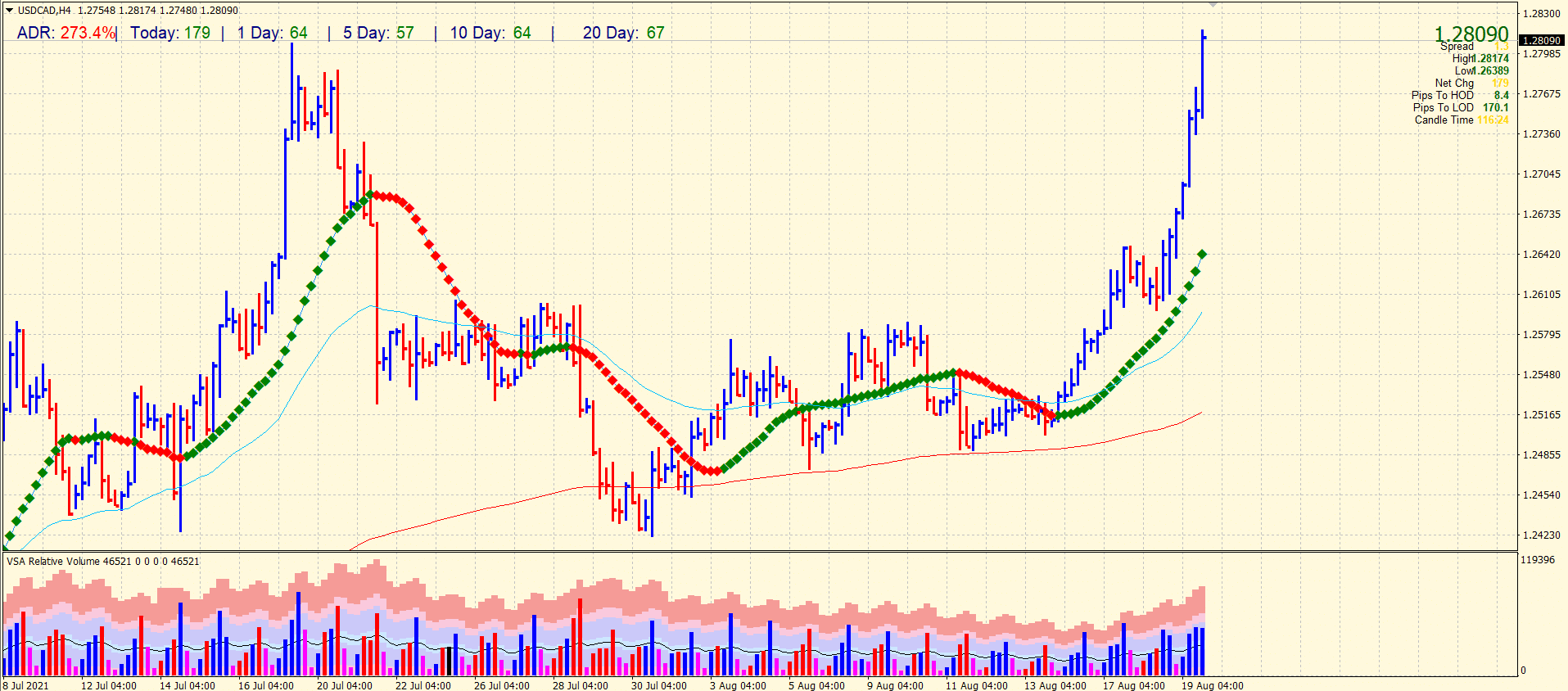

USD/CAD price technical analysis: Bulls skyrocket price above 1.2800

The USD/CAD pair has covered the 273% average daily range on Thursday, which is quite abnormal. The pair has broken the 1.2800 key resistance, which was a swing high of July 19. The pair is extremely bullish, lying well above the key SMAs. However, after such a huge gain, it is obvious that the pair may find some retracement. However, after breaking the 1.2800 marks, we can assume further resistance near the 1.2850 area. The volume is too high for the past few 4-hour bars. Such a volume is followed by buying absorption or profit-taking that can send the pair lower.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.