- After a steep correction on Tuesday, USD/CAD is rising towards 1.2700 again.

- USD strength buoys the spot as risk-off sentiment pushes WTI bulls to take a break.

- The fresh direction will likely come from US data dumps and FOMC minutes.

The USD/CAD price analysis shows that the minor downside correction is over, and the pair is again back on track to post fresh highs.

At the time of writing, the USD/CAD pair is trading at 1.2685 with a daily gain of 0.15%.

–Are you interested to learn more about forex signals? Check our detailed guide-

The USD/CAD pair is likely to move back above 1.2700 as it finds strong bids around 1.2660 and the US dollar increases across the board.

The dollar holds its recent gains as risk sentiment remains subdued amid growing concerns over the Fed’s projections regarding rate hikes revealed in the minutes of the FOMC meeting.

Additionally, several important US data, including durable goods, PCE inflation, and GDP, will provide new indications of economic recovery, which could complement speculation about a Fed rate hike.

Similarly, the pause in rises in WTI oil price is also helping calm USD/CAD bulls. Trader disappointment over US Strategic Oil Reserve (SPR)’s less-than-expected oil release consolidated US crude’s two-day rebound to $ 78.79.

The USD/CAD price action is expected to be driven by oil and US dollar sentiment ahead of reports on the US economy.

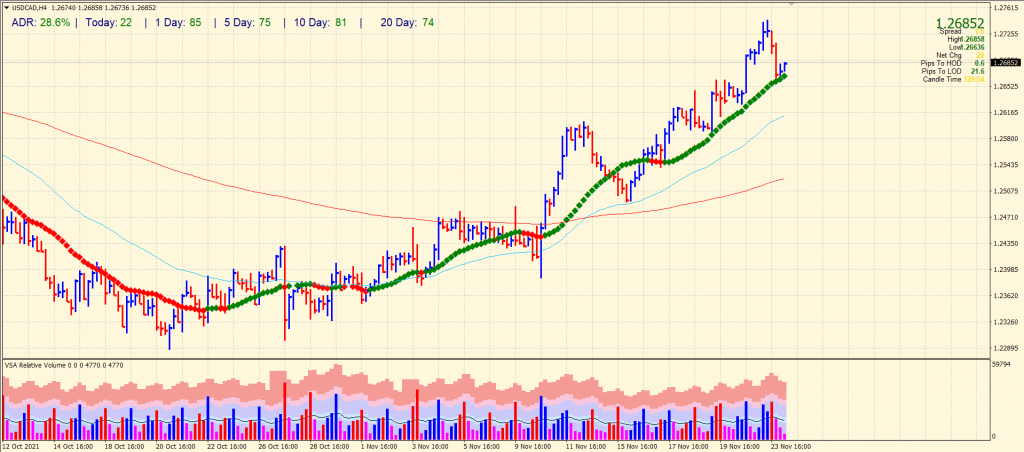

USD/CAD price technical analysis: Bulls vs. bears around 1.2700

The USD/CAD price turns positive on the day after hitting the strong support level at 1.2660. The same level coincides with the 20-period SMA on the 4-hour chart. If the pair stays above the level, we may find a retest of monthly highs around 1.2740 area. Despite finding the support, the up wave does not show a rising volume. Rather a declining volume indicates that the upside wave could only be corrective in nature.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

If the support at 1.2660 does not hold, we may see a test of 50-period SMA around 1.2610 ahead of 200-period SMA around 1.2525. However, the recent stance is neutral. So, it is prudent to wait for a decisive breakout on either side.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.