- The BOC could bring sharp movements in both directions.

- A new higher high activates further growth.

- The bias is bullish as long as it stays above the uptrend line.

The USD/CAD price continues to rally as the US dollar hits new highs. The pair is trading at 1.3177 below 1.3199 today’s high.

–Are you interested in learning more about forex signals? Check our detailed guide-

Fundamentally, the USD took the lead again, even though the US data came in mixed yesterday. The greenback received a helping hand from the ISM Services PMI, which was reported at 56.9 points above 55.4, signaling further expansion.

Today, the fundamentals could drive the market. As you already know, the Bank of Canada is expected to increase the Overnight Rate from 2.50% to 3.25%. The BOC Rate Statement could bring high volatility and sharp movements. In addition, the Canadian Trade Balance could be reported at 3.8B, while the Ivey PMI could drop from 49.6 to 48.3 points.

Also, the FOMC members Mester, Brainard, and Barr’s speeches could bring volatility. Tomorrow, the ECB is seen as a high-impact event and could significantly impact the USD. The USD/CAD pair anticipate high volatility in the wake of Friday’s Unemployment Rate and Employment Change data.

USD/CAD price technical analysis: Bullish bias

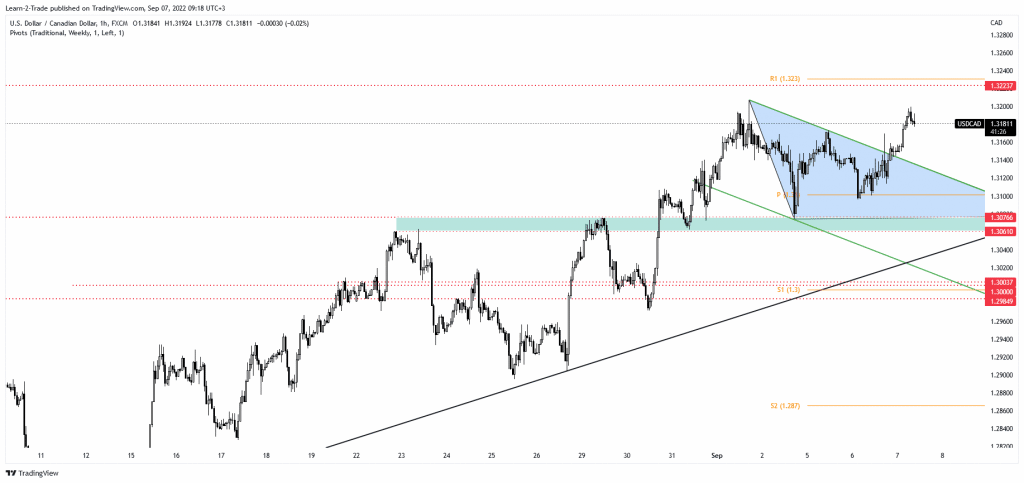

From the technical point of view, the USD/CAD pair retreated a little within a potential down-channel, but it has found support above the 1.3061 – 1.3076 area. In the short term, it has developed a triangle pattern.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Now, it has broken out from these short-term chart formations. The 1.3200 psychological level and the 1.3207 represent near-term resistance levels. Also, the 1.3223 historical level represents an upside obstacle.

A valid breakout through the 1.3223 and above the weekly R1 may trigger an upside continuation. False breakouts may signal a new short-term retreat. The price will likely test the broken descending trendline before resuming its growth. The outlook is bullish as long as it stays above the ascending trendline, so downside corrective moves could bring new long opportunities.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.