- The USD/CAD gained momentum for a third straight day on Monday, reaching a new year-to-date high.

- As crude oil prices fell, the Canadian dollar was undermined but bolstered by robust dollar buying.

- The safe-haven dollar has profited from aggressive Fed rate hikes and prevailing risk-off sentiment.

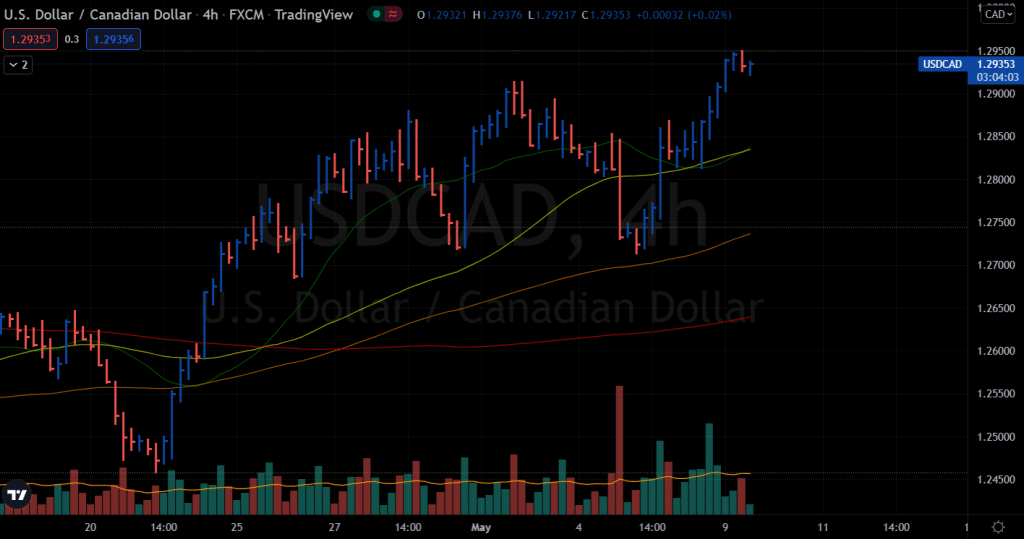

The USD/CAD price traded in the 1.2935 range during the European session, just a few pips off its year-to-date high.

–Are you interested in learning more about STP brokers? Check our detailed guide-

A combination of factors contributed to the USD/CAD pair’s third day of gains on Monday, building on its recent strong bullish move. First, a more aggressive Fed tightening possibility led to a surge in the US dollar near its two-decade high. Furthermore, falling crude oil prices served as a tailwind for the major Canadian currency and undermined the commodity-linked currency.

Last week, Jerome Powell, chair of the Fed, said that a 75 basis point hike was not actively considered. Markets believe, however, that the US Federal Reserve should take stronger action to curb inflation and continue to expect another 200 basis point hike by the end of 2022. This, in turn, drove bond yields higher. As a result, the dollar strengthened as the benchmark 10-year US Treasury bond hit its highest level in over a decade.

A rapid rise in US interest rates and Chinese lockdown restrictions fuel fears of a recession and a slowdown in global economic growth. The result was a dampening of investor appetite for risky assets and a dampening of crude oil prices, despite concerns about supply cuts. Furthermore, Friday’s somewhat unassuming Canadian jobs report supported the USD/CAD pair.

What’s next to watch?

Neither the US nor Canada is expected to release any major economic data on Monday. Therefore, US bond yields and market risk sentiment will continue to play an important role in stimulating demand for the US dollar. In addition, for short-term opportunities in USDCAD, traders will continue to monitor oil prices.

–Are you interested in learning more about making money with forex? Check our detailed guide-

USD/CAD price technical analysis: Buyers to face 1.3000

The USD/CAD price remains positive as the 20-period and 50-period SMAs on the 4-hour chart have formed a bullish crossover. As long as the price remains above these SMAs, buyers will remain in charge. However, the volume remains below average. The buyers may face stiff resistance around the 1.3000 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money