- The USD/CAD pair dropped after reaching a major resistance zone.

- A temporary consolidation followed by a new higher high could bring new long opportunities.

- It could only test and retest the immediate support levels before jumping higher again.

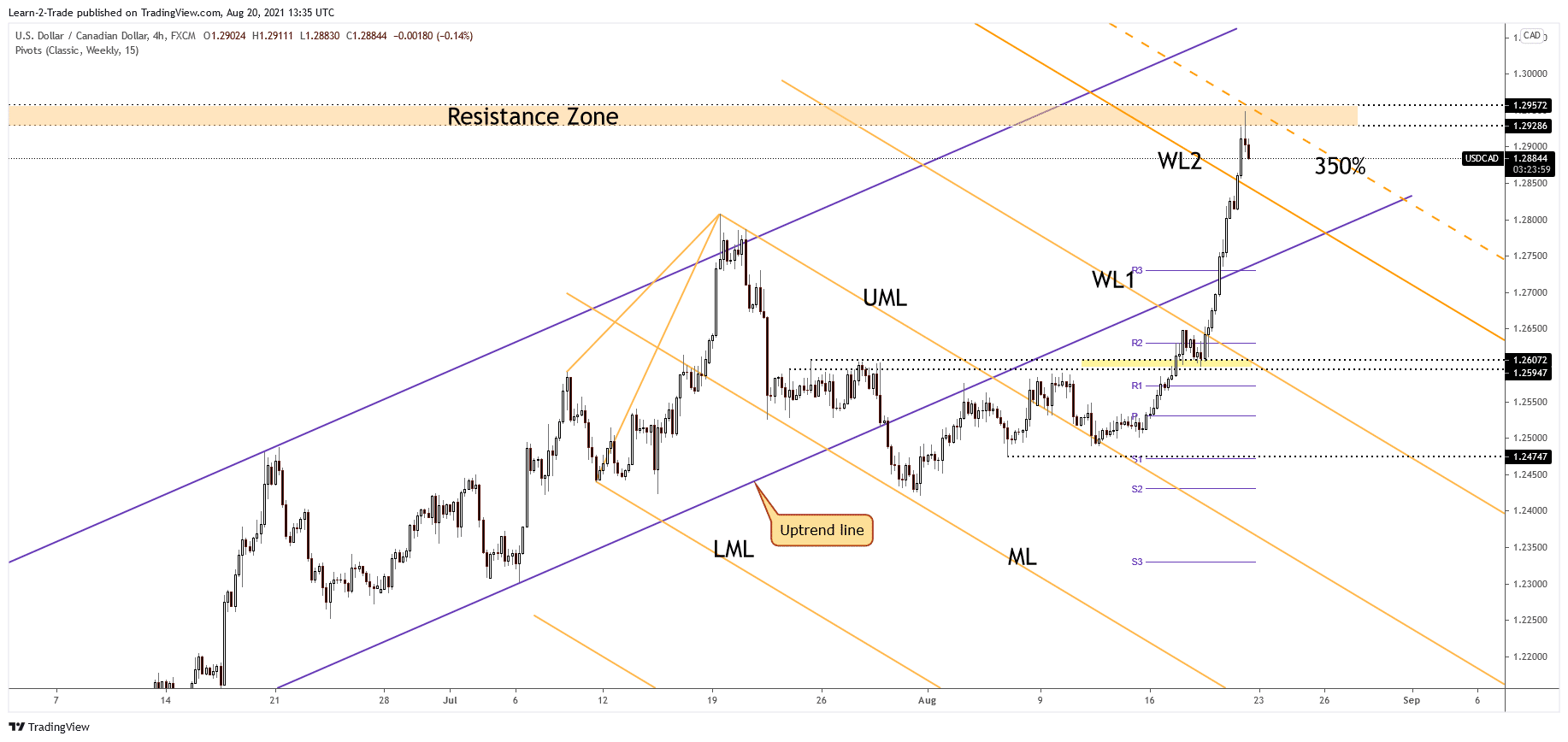

The USD/CAD price drops after reaching a major resistance area. The price action has printed a Pin Bar signaling a potential reversal. Technically, a temporary decline was somehow expected after the most recent upwards movement.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

It could come down to test and retest the immediate support levels before jumping higher again. The bias remains bullish despite temporary declines. The pair also drops because the Dollar Index drops right now. Also, the DXY has registered an amazing rally, so a temporary decline is understandable.

The Loonie has taken the lead as the Canadian Retail Sales has surged by 4.7%, versus 4.5% expected and compared to -1.7% drop registered in the previous reporting period. Furthermore, the Retail Sales has raised only by 4.2% in June compared to 4.4% expected, but it’s still good after the 1.9% drop in May.

USD/CAD price technical analysis: Will resistance hold?

The USD/CAD price has raised as much as the 1.2948 level today, where it has found resistance again. It has failed to reach 1.2957 static resistance signaling exhausted buyers. It has printed only a false breakout through 1.2928 static resistance.

The pair has registered an amazing rally after failing to activate a larger correction after escaping from the down channel’s body. It is almost to reach the second warning line (WL2) of the former descending pitchfork after failing to reach the 350% Fibonacci line.

–Are you interested to learn more about forex signals? Check our detailed guide-

1.2807 level, the former higher high is seen as strong support, the resistance has turned into support. Staying above the second warning line (WL2) and beyond 1.2807 static support indicates that the USD/CAD pair could rise again.

The current drop could be only a temporary one. It could resume its upside journey if the Dollar Index resumes its upwards movement. We cannot talk about a larger decline as long as it stays above the immediate support levels.

A minor consolidation in the short term, a temporary range could attract more buyers again, which could lead the USD/CAD pair higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.