- Canada’s job market is facing inflationary pressures that might force the BoC to act fast.

- The BoC is expected to raise rates by 75 bps.

- The price might experience SMA support in the charts.

The weekly USD/CAD forecast is bullish as Canada’s economy faces a possible recession that may weigh on the Canadian dollar.

Ups and Downs of USD/CAD

Last week, Canada received mixed economic data, with a higher-than-expected trade surplus and a lower-than-expected employment change. In May, Canada exported more than it imported in May, with energy-boosting exports. Canada benefited from the expensive oil in May, seen in the trade surplus, which hit a 14-year high.

–Are you interested to learn more about forex options trading? Check our detailed guide-

However, Friday saw employment data released showing a higher-than-expected job decline, showing a slowdown in the economy. It is also clear that inflation has hit the job market, and the Bank of Canada will have to act fast.

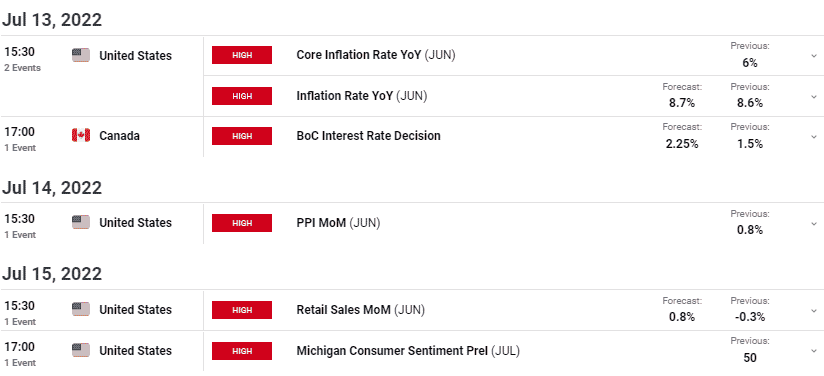

Next week’s key events for USD/CAD

Next week will be volatile for USD/CAD as the Bank of Canada is set to raise rates. There was a surprise decline in Canada’s jobs on Friday while the unemployment rate fell. The Bank of Canada is expected to raise rates by 75bps at the next meeting, and this jobs report shows high inflationary pressures.

“If anything, the data points to a tighter labor market, which is inherently inflationary,” said Andrew Kelvin, chief Canada strategist at TD Securities. “Nothing about this report will give the BoC (Bank of Canada) pause from hiking by 75 basis points next week.”

USD/CAD investors will also pay attention to the US inflation data next week. Investors expect inflation to go up by a percentage point. The Fed has room for a tighter monetary policy to control inflation, which might see the US dollar rally.

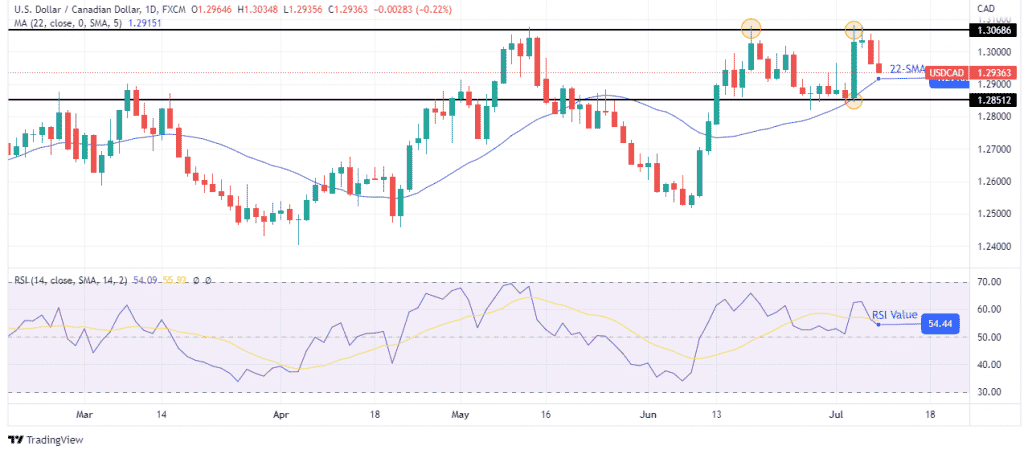

USD/CAD weekly technical forecast: Support at the 22-SMA

The daily chart shows the price attempted a break above 1.30686, a solid resistance level, but failed. The price has pulled back to the 22-SMA, which might act as support, as it did on July 5. There is no doubt who is in charge as the RSI is trading above 50, showing bullish momentum.

–Are you interested to learn about forex robots? Check our detailed guide-

At the current price, USD/CAD might attempt another break above 1.30686 in the coming week, or it might break below the 22-SMA and retest the July 5 support at 1.28512. The trend will turn bearish if the price starts trading below the 22-SMA and the RSI goes below 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money