- As Omicron fears it will ease, WTI rises 5.1% for the week.

- Following Monday’s closing price of 1.2940, USD/CAD reversed.

- According to initial speculation, a rate hike from the Fed has been postponed to March 2020.

The USD/CAD weekly forecast remains bearish as the WTI rises, setting a trend reversal near the key levels above 1.2900. Any abrupt move in WTI will affect USD/CAD directly in the coming week, as liquidity is expected to be tight.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

As the outlook for global recovery improves as the Omicron threat subsides, WTI could reach $75.50 and $78.00. This will push USD/CAD towards 1.2700. In the absence of any significant US statistics, the market vulnerability will be exaggerated either for Canada or for the central bank’s contribution.

The crude oil price remains 12.3% below its October 26 closing price of $84.05, partly due to Omicron’s panic of November 26. During the day, oil fell 12.8% from $78.10 to $ 69.10. WTI closed Thursday at $73.70, just above the middle of the daily decline of $73.10.

The prospect of recovery for WTI and the world will improve markedly if the Omicron option does not threaten the health and well-being of the global economy as feared Friday.

Many countries and some states in the United States have seen a rise in cases without corresponding hospital admissions or deaths. While the economic uncertainty caused by this wave of pandemics remains high, the outlook for the global economy is improving every day.

Data indicate that the US was generally strong, but only durable goods orders were positive.

The Fed’s preferred inflation measure, PCE prices rose to 5.7% annually in November, the highest level in 39 years, and climbed sharply from 5.1% in October. This was the highest PCE price index since September 1983, compared with 4.2% in October.

Fed Chairman Jerome Powell said the bank intends to finalize its bond program before the Fed’s rate hike on December 15. The bond program is expected to be completed by March. The Federal Open Market Committee (FOMC) meeting is scheduled for April 3-4. The first rate hike is expected to occur in May.

Fed Chairman Christopher Waller said on Friday after the December FOMC meeting that the goal of increasing the cut to $30 billion is to extend the program through the December FOMC meeting. The program will end in March. Waller said he was available to increase Fed funding to “bring this meeting to life.”

The comments of Mr. Waller changed the dynamic of the relationship between the Bank of Canada (BOC) and the Federal Reserve (Fed). It was expected that the Bank of China would hike rates first in April, and the Fed would wait until its May 3 and 4th meeting. As a result, Chicago Board Options Exchange (CBOE) reported an upside probability of 56.5% on Friday afternoon at its March meeting.

The Canadian data was constrained by October retail (sales) data which was 1.6% better than expected but was not significant to retailing.

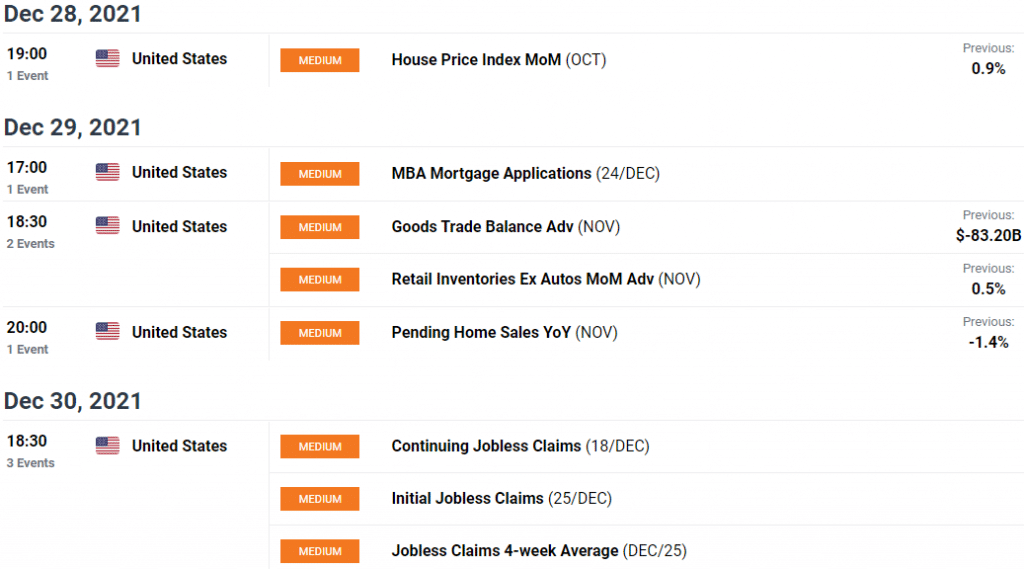

Key data/events for USD/CAD

Traders should be aware that levels seen in the final weeks of December are often completely reversed by the market in January.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

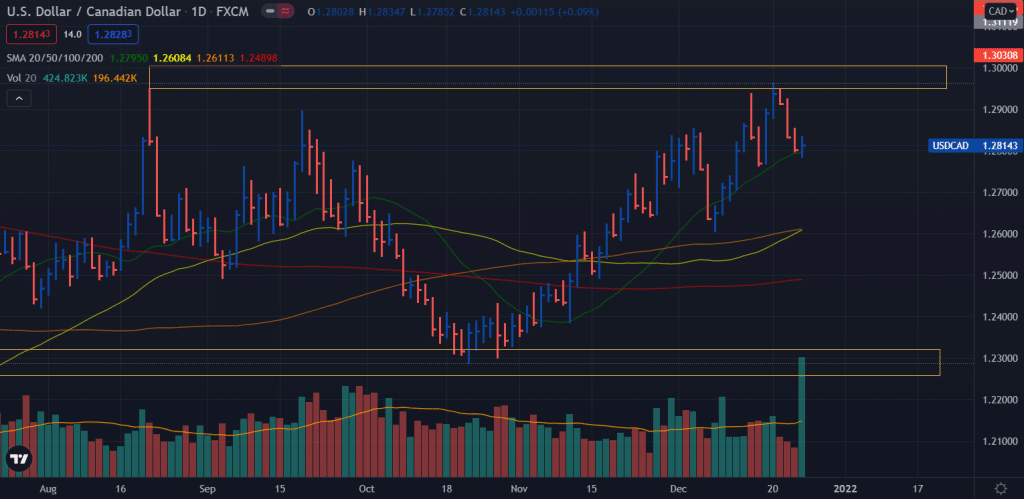

USD/CAD weekly technical forecast: Bulls rejected by supply zone

The USD/CAD price found rejection around the supply area and fell back to the support of 20-day SMA. However, breaking the support may attract attention towards the confluence of 50-day and 100-day SMAs around 1.2600. On the upside, 1.2900 will remain a tough nut to crack ahead of psychological resistance of 1.3000.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.