- The Canadian economy grew by 0.5% in January.

- Although US inflation decreased in February, it stayed high enough for the Fed to hike rates.

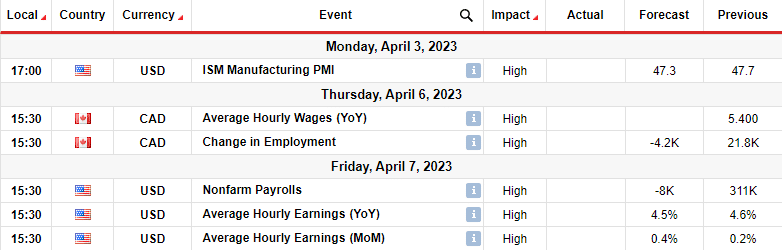

- Investors are awaiting the US nonfarm payroll report.

The USD/CAD weekly forecast is bearish as the Canadian dollar soars amid upbeat economic data and the greenback’s broad weakness.

Ups and downs of USD/CAD

On Friday, the Canadian dollar dipped slightly against the US dollar. However, it remained close to its highest level in over five weeks, as domestic data revealed that the economy was expanding faster than anticipated.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

The Canadian economy grew by 0.5% in January, exceeding the 0.3% rise that economists had predicted.

The US published mixed figures, with GDP, jobless claims, and inflation lower than expected, while consumer confidence and pending home sales rose.

Although inflation decreased in February, it stayed high enough for the Federal Reserve to raise interest rates one more time this year, possibly. Consumer spending in the US rose slightly in February.

Additional data showed consumer confidence in the United States dropped in February for the first time in four months. This was due to concerns about an impending recession, even though the impact of the recent banking crisis was comparatively mild.

The likelihood of a 25bps Fed hike in May fell to about 50%.

Next week’s key events for USD/CAD

The monthly payroll report due next week will provide investors with an update on the health of the labor market, which has proven resilient over the past year. Investors will also pay attention to employment data from Canada.

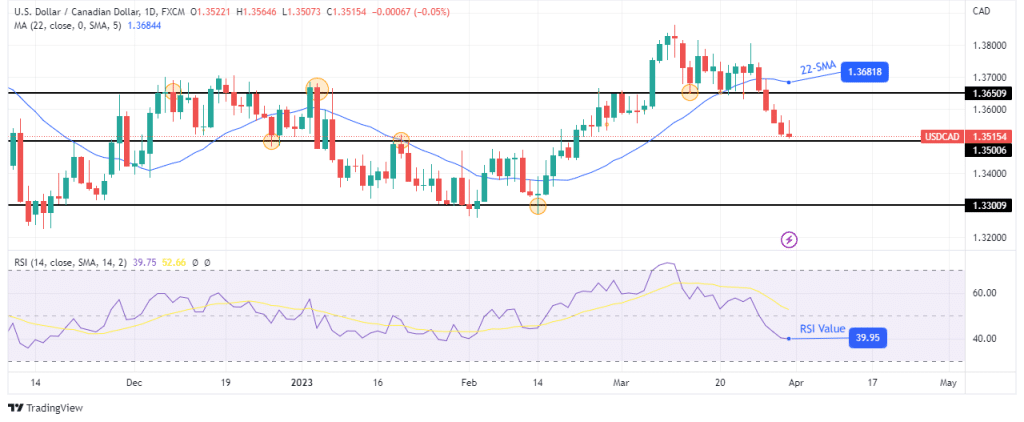

USD/CAD weekly technical forecast: Impulsive down leg

The daily chart shows USD/CAD trading well below the 22-SMA with the RSI below 50. These indicators show the current move is bearish. Bears took control of bulls when the price broke below the 22-SMA and the 1.3650 support level. The move lower was explosive and impulsive, showing strong momentum.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

However, the price is approaching strong support at the 1.3500 key psychological level. This might result in a short pause or pullback before the price breaks below. However, given the strength of the bearish move, we might see the price break right through the support in the coming week. A break below 1.3500 would allow bears to set their sights on the next support at 1.3300.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money