- The pair ended the week higher as the dollar rose across the board.

- The parties involved in the US debt ceiling talks failed to reach an agreement.

- Investors have increased their bets on a June Fed hike.

The USD/CAD weekly forecast is bullish as investors have increased their bets on a rate hike by the Fed in June.

Ups and downs of USD/CAD

In the past week, the dollar largely controlled the USD/CAD as there were no significant economic releases from Canada. The pair ended the week higher as the dollar rose across the board.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

Notably, the dollar benefited from its status as a haven during the ongoing US debt ceiling discussions. Despite multiple stakeholder meetings, uncertainty clouded the outcome of the US debt ceiling matter. The parties involved could not reach an agreement. Consequently, the US government could default on its debt obligations within a week, leading to a recession.

Furthermore, the US published data on services PMI, GDP, initial jobless claims, and the core PCE price index. Notably, most of these economic releases indicated a resilient economy, prompting investors to increase their bets on a June Fed hike.

Next week’s key events for USD/CAD

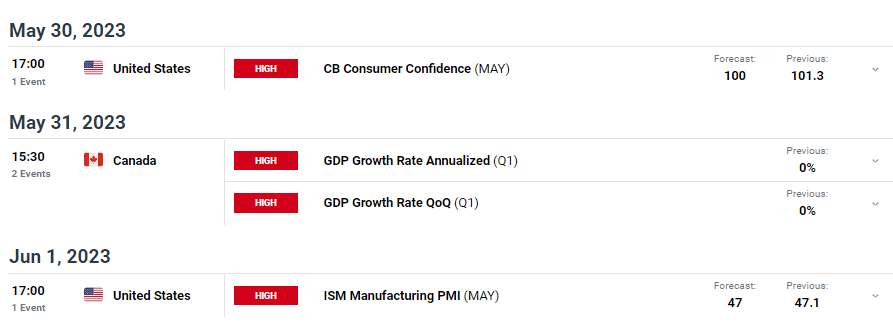

Next week, investors will focus on three significant news releases, which comprise the CB consumer confidence and the ISM manufacturing PMI from the US. The US ISM manufacturing PMI will provide insights into the level of business activity within the manufacturing sector. On the other hand, the consumer confidence report will show consumers’ confidence in the US economy.

Finally, investors will focus on GDP data from Canada for Q1. The data will show whether Canada’s economy grew or contracted in the first quarter.

USD/CAD weekly technical forecast: Bulls testing the 1.3650 resistance level

The daily chart’s bias for USD/CAD is bullish because the price trades above the 22-SMA, while the RSI is above 50, indicating strong bullish momentum. The bulls have pushed the price from the 1.3450 support to the 1.3650 resistance.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Now the price is facing a strong resistance level at 1.3650. Therefore, if the bullish momentum continues next week, we might see the price push above this resistance level. This would allow bulls to set their sights on the next resistance level at 1.3851. However, if bears return at 1.3650, the price will likely fall back to the 22-SMA support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.