- USD/CHF is expected to weaken further amid a weakening DXY.

- There is hope that the Russian-Ukrainian conflict will de-escalate after some Russian rebels depart.

- Russian-Ukrainian peace talks were a fruitful example of impulsive risk.

The USD/CHF outlook remains negative as the US dollar bulls run out of steam amid positive risk sentiment, resulting in a flow out of safe-haven assets.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

As market participants’ increased risk appetite shifts liquidity away from safe havens and into riskier currencies, the USD/CHF price falls. As a result, despite last week’s low of 0.9260, the asset is expected to remain weak.

Optimism from the Russian saga

Following the withdrawal of Russian troops from Ukraine, the mood of market participants has improved due to the de-escalation of relations between the two countries. Russian rebels agreed to renounce alliances and withdraw from northern Ukraine and Kyiv as part of their first face-to-face meetings with Ukrainian officials in Turkey. However, the Russian chief negotiator said a formal deal with Kyiv is still a long way off as Russia’s pledge to reduce hostilities does not mean a ceasefire. However, many investors still see the move as a possible step toward a truce.

Greenback pares gains

Due to optimistic market sentiment, the US Dollar Index (DXY) is expected to drop below 98.00. However, the improvement in the US consumer confidence index was ignored by market participants. Consumer confidence in the US rose to 107.2 in March, up from 105.7 released a month earlier and a tad above expectations of 107.0. The data showed that US citizens feel more confident about their country’s economic performance.

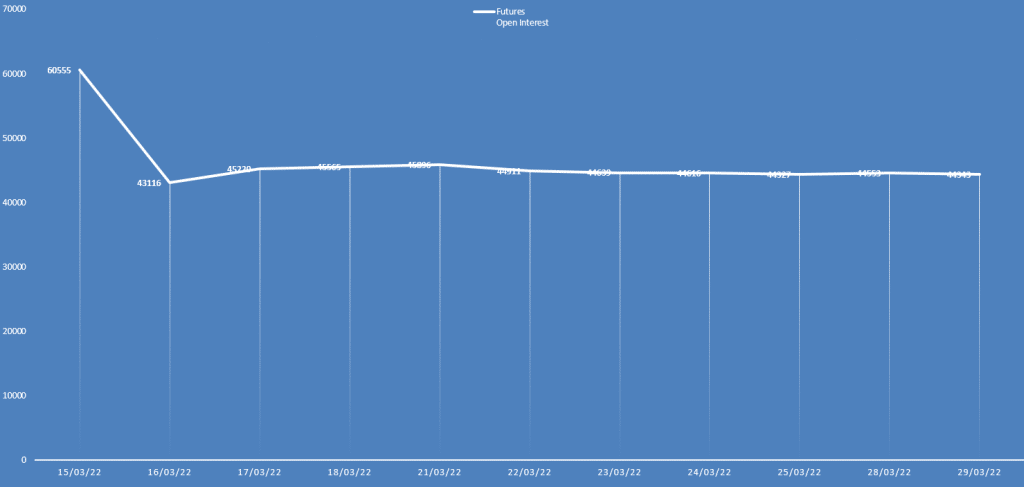

USD/CHF daily open interest outlook

The USD/CHF price closed lower on Tuesday, while the daily open interest showed no significant change. Therefore, it shows no clear directional bias.

What’s next to watch for the USD/CHF outlook?

The US Nonfarm Payrolls (NFP) report, due Friday, will remain one of the most important events for the market this week. In addition, ADP gross domestic product (GDP) and employment data are scheduled for release on Wednesday, but investors will be watching these data first.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

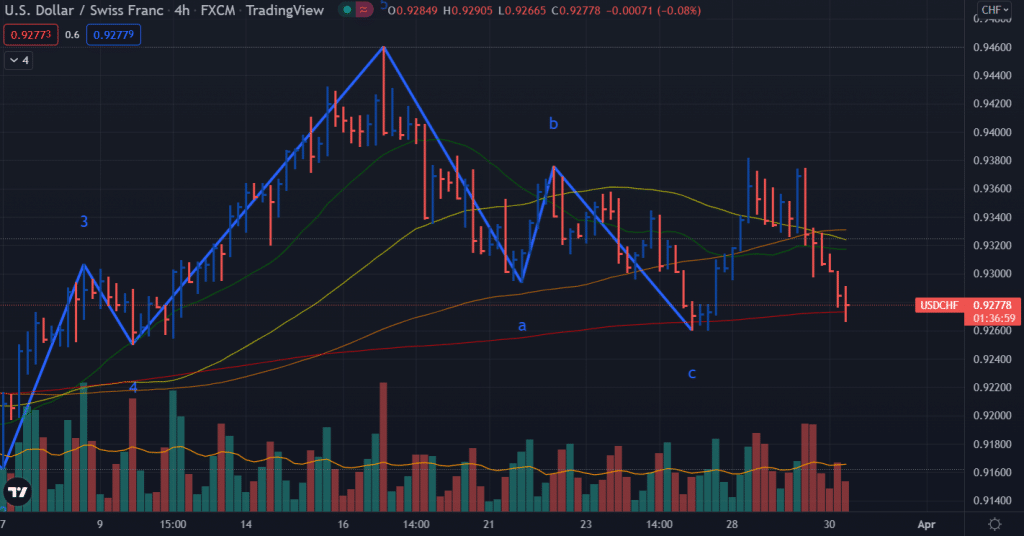

USD/CHF price technical outlook: 200-SMA to support

The USD/CHF price remains strongly negative as the key SMAs on the 4-hour chart point to the downside. The chart shows several down bars with very high spread and high volume. As of now, the pair is toying with the 200-period SMA. Breaking below the level will gather more selling and aim for a 0.9200 area.

Alternatively, if the price finds some respite around the 200-period SMA, we may see a rise towards 0.9300 followed by 0.9350.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money